The first Reserve Bank of Australia monetary policy meeting for 2018 is today, with the announcement and statement due at 0330 GMT.

- An on hold decision is expected.

I'll have previews to come for this, but here is a few already:

- RBA meet this week - preview

- Australia - RBA meet for the first time in 2018 next week - preview

- AUD traders - RBA meet this week, first for the year - preview

Prior to the RBA we'll get data from Australia today; retail sales and trade balance, both for December.

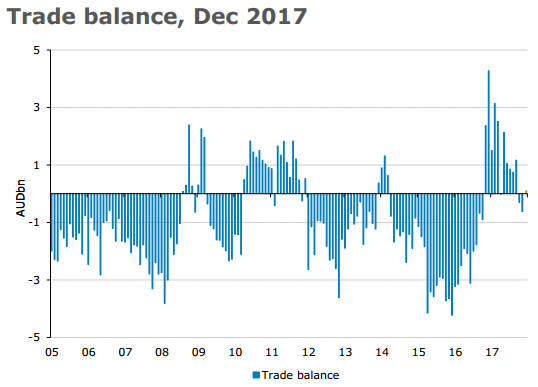

For the trade balance, this preview via ANZ:

We expect Australia's trade balance to have improved to a surplus of AUD100m in December.

- November's underwhelming result was partially caused by softer-than-expected iron ore and coal exports. Subsequent ports data has been very strong - Port Headland's iron ore exports set a monthly record in December.

- Australia's imports should continue to rise as well, supported by higher oil prices.

---

Via Westpac:

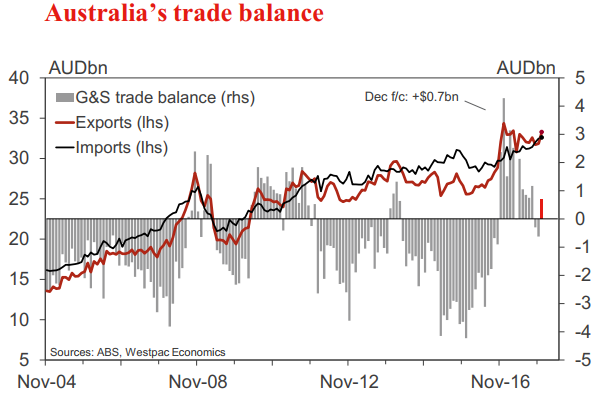

Australia's trade balance slipped into deficit in October and November on a dip in exports

For December, we anticipate a return to surplus, a forecast $0.7bn, a $1.3bn turnaround on November, led by a rebound in exports

- Export earnings in December increased by a forecast 4.5%, $1.4bn, centred on iron ore, coal and LNG, reflecting a rebound in volumes and higher prices

- Imports are expected to edge higher, 0.4% (+$0.1bn), on rising volumes. Prices are likely little changed, with the currency consolidating in the month, so too global energy prices.

---

National Australia Bank:

- The trade balance is expected to return to surplus, as commodity exports bounce back

---

Also due from Australia today, retail sales for December: