Forex and cryptocurrency news from the European morning trading 20 Mar 2018

News:

- BOJ's Amamiya and Wakatabe: Priority is hitting inflation target as soon as possible

- BOJ's Amamiya says that Japan is no longer in deflation

- Japan official says yen movement has been too volatile

- China wants intellectual property dialogue with the US

- China premier Li says there is no winner from a trade war between US and China

- China Premier Li: China will further lower import tariffs

- China says WTO has already ruled against tariffs directed at them

- Trudeau says to discuss US steel tariffs at G7 meeting in June

- G20 says cryptocurrencies are more like an asset than it is to money - report

- EU draft of Brexit guidelines seek improved equivalence mechanisms - Bloomberg

- Japan, China, and South Korea agree on Tokyo summit - report

- Pound still making its mind up after softer UK inflation data

- China's premier Li says that country's economic fundamentals are sound

- Dollar gains across the boardOPEC and non-OPEC committee said to see oil market rebalancing by Q3 - report

- Ex-Japanese tax chief Sagawa is to testify in parliament next week - Reuters

- USD/JPY breaks above stubborn near-term resistance level

- Yen extends decline on the day

- Switzerland 2018 GDP seen at 2.4% in latest forecast

- Nomura says UK inflation figures "unlikely to rock the sterling trend"

- Commerzbank says USD/JPY is to remain range-bound in the very near term

- Danske Bank does not rule out further EUR/USD upside

- Economists see a BOE rate hike in May as increasingly likely - survey

- Another important reminder that ONS data will be rescheduled starting from April

- Trading ideas for the European session 20 March

- Nikkei 225 closes lower by 0.47% at 21,380.97

- ForexLive Asia FX news: USD/JPY and yen crosses up a little

Data:

- UK February CPI mm +0.4% vs +0.5% exp

- UK February PPI output NSA 0.0% vs +0.1% m/m expected

- Germany March ZEW survey current situation 90.7 vs 90.0 exp

- Germany February PPI m/m -0.1% vs +0.1% expected

- Switzerland February trade balance CHF 3.14 bn vs CHF 1.32 bn prior

- Japan February convenience store sales y/y +0.3% vs +0.1% prior

- Japan February final machine tool orders y/y +39.5% vs +39.5% prelim

- Japan January final leading indicator index 105.6 vs 104.8 prelim

A scrappy session but with good two-way business and USD demand notable overall.

Yen weakness the early standout with USDJPY rallying through 106.20-30 in a rush to 106.61 on not a lot but in thin liquidity.We've since been back to look at 106.20 amid a raft of comments from the BOJ before finding dip buyers again.

GBPUSD had held decent support lines around 1.4020 and rallied to 1.4665 but then fell again into and after the softer CPI data helped by general USD demand but also a little GBPJPY supply too.

EURUSD was holding above 1.2330 but then soggy ZEW expectations sent it down to test 1.2300 with EURGBP trading 0.8775-95.

USDCHF still underpinned around 0.9500 but sell interest around 0.9550 but with EURCHF still steady despite some EUR losses elsewhere.

AUDUSD has large option interest at 0.7710-20 and helping to contain range while both USDCAD and NZDUSD are also contained. GDT auction result due today.

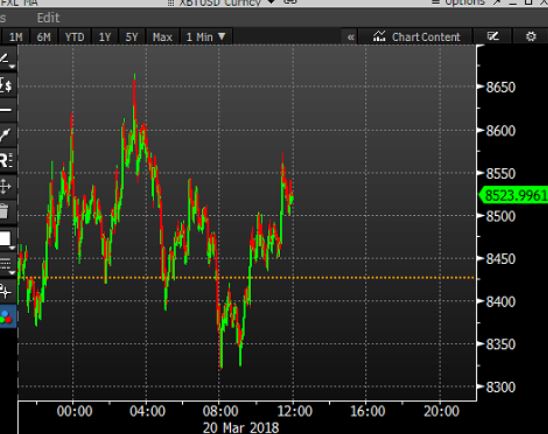

Bitcoin has had a better session after Asian retreat from $8550 to $8330 and we've retraced the losses as I type.

Gold has fallen , oil has risen with trade war backstory also still playing out

Data coming up: