Forex news for NY trading on March 1, 2018

- US stocks end a rocky session with sharp declines

- BoC Gov. Poloz - comments on 'uncertainty' (re policy etc.)

- New Zealand ANZ Consumer Confidence Index (February): +0.6% m/m (prior +4.2%)

- US total vehicle sales come in at 17.08M vs 17.20M estimate

- Dollar moving lower as confidence erodes

- EU Juncker: strongly regrets US restriction on steel and aluminum affecting EU

- Canada trade minister: Any US tariff quota imposed on Canadian steel would be unacceptable

- US plan to impose tariffs on steel is violating WTO rules

- CAD getting hurt on the tariffs too

- USDJPY (and JPY crosses) feeling the negative from the falling stocks

- Stocks sliding on the tarriff/trade war concerns

- AUDUSD falls after US tarriff announcement

- Trump will impose 25% tarriff on steel and 10% on aluminum

- Powell concludes testimony. What did we learn today?

- Powell: 4 rate hikes this year would be "gradual"

- European stocks take it on the chin today. Not a good start to March.

- Dudley: Confident US economy will perform over the next 1-2 years

- ECB unlikely to signal policy shift at March meeting - report

- Bill Gross takes a swipe at the Fed's view on inflation

- Fed's Dudley: Trade benefits supply side of the overall economy.

- Powell: We don't want to run too far past neutral employment rate

- Fed's Powell: More strengthening can take place in jobs market before wage inflation

- US January construction spending mm 0.0% vs 0.3% exp

- February US ISM manufacturing index 60.8 vs 58.7 expected

- Markit US Feb final manufacturing PMI 55.3 vs 55.9 expected

- EU's Barnier says they are ready to look at UK's ideas on Irish border

- Canada Feb Markit PMI 55.6 vs 55.9 prior

- US initial jobless claims 210K vs 225K expected

- Canada Q4 current account CAD -16.35 bln vs -17.5bln exp

- US January PCE core +1.5% y/y vs +1.5% expected

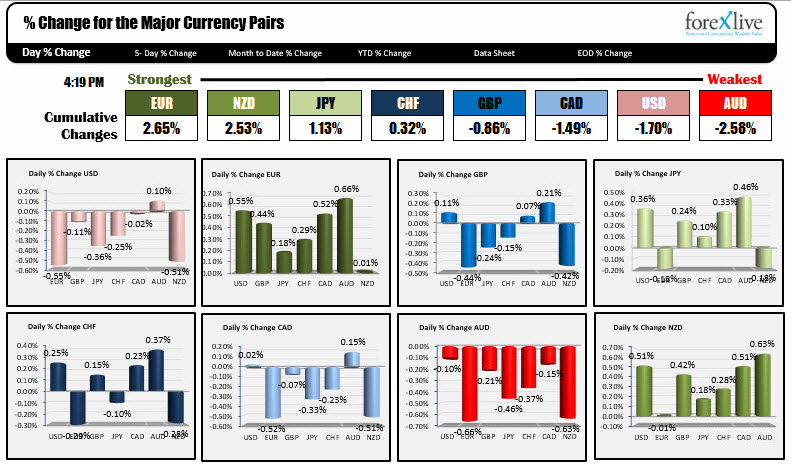

- The NZD is the strongest. The AUD is the weakest as NA traders enter for the day.

In other markets near the close of the day:

- Spot gold is trading down $1.84 or -0.14% at $1316.53. This is well off the low of $1302.85. The price was boosted by the falling dollar.

- WTI crude oil futures are ending down $-.31 or -0.50% at $61.32 the low price reached $60.18 while the high extended to $61.83

- Bitcoin is trading up $435 at $10,966 on the Coinbase exchange

The day was full of economic data:

- US initial claims came in at the lowest level since 1969. Strong

- PCE core came in at 1.5% as expected and no change from the prior month. No inflation.

- Personal spending rose a modest 0.2%. Personal income rose 0.4%. The income was better than 0.3% expected

- ISM Manufacturing PMI came in at 60.8 versus 58.7. Big beat. Lots to be optimistic about in the report. Strong.

The data was good enough for the Atlanta Fed estimate to be revised to 3.5% from 2.6%. That is a healthy jump.

Fed chair Powell was the next key event as he gave his second testimony on Capitol Hill to the Senate Finance Committee. On Tuesday, he was thought to be more hawkisk and the dollar moved higher and stocks fell

Today, I would characterize the comment at first to be a little less hawkish.

- "More strengthening can take place in the jobs market before wage inflation".

- "No evidence the economy is currently overheating"

- On wages, he did say that he would expect to see more wage hikes but he added "That's what we're waiting to see". As in, it has not really shown up yet.

- To prolong the recovery we believe "gradual" hikes is the best course of action

Then right toward the end of the testimony, he defined "gradual" by saying 4 hikes would be considered "gradual".

That started a fall in stocks.

However, things did not really heat up in the markets until it was announced that Trump would impose a 25% tariff on steel and 10% tariff on aluminum.

It had been known that Trump might impose the tariffs, but earlier in the session the White House called off a 11 AM ET press conference, and instead called a meeting of steel and aluminum leaders and other government officials.

As a result, the news surprised the market, led to an acceleration of stock selling as concerns about a trade war escalated.

Bond yields tumbled and eventually the dollar started to erode too.

It was a tariff-ible day for stock and dollar buyers, and if you were looking for higher note and bond yields, you ended up scrambling too.

At the end of the day, the S&P index fell -1.33%, the Nasdaq fell by -1.27% and the Dow tumbled -1.68%. The steel and aluminum companies benefited but there were few others that escape the sharp decline.

The 10 year bond yield moved from a high of 2.8733% to a low of 2.7933% (settled near 2.808%).

In the forex market, the USD which was higher at the start of the day (in anticipation of a hawkish Powell perhaps and some better data) ended the session with declines against most all of the major currency pair with the exception of the AUD (which was pressured on the back of the tariffs).

The nitty gritty of the tariff are to be released next week. Meanwhile, there have and will continue to be plenty of comments from the rest of the world. However, the President - and some White House officials (Gary Cohn was not in his corner on this one) - are intent on righting a wrong from unfair trade policy that has decimated the steel industry - mainly from China. How the cards end up being played - i.e. what about Mexico and Canada, German Steel Association was balking, and EU officials spoke up - will be determined over the course of the next few days (to start).

We will see but for today, it was a tariff-ible day.