Forex news for NY trading on August 9, 2017

- US stocks end with modest losses (it could have been worse)

- Lots of UK data to be released tomorrow

- US crude oil futures settle at $49.56

- NZDUSD waffles back and forth ahead of the RBNZ statement

- Euro pulls another bait-and-switch

- 'We're in a different era on inflation' - Fed's Bullard

- Fed's Bullard: Not too optimistic on inflation gains this year

- Fed's Evans: Recent inflation weakness raises questions on outlook

- US sells 10-year notes at 2.250% vs 2.235% WI bid

- Bitcoin technicals: Corrective action finds support at a lower trend line

- Goldman Sachs sees generally softer US dollar and yen in latest forecasts

- European equities slump on geopolitical worries

- Atlanta Fed Q3 GDPNow forecast 3.5% vs 3.7% previously

- Oil chops after weekly storage report on jump in gasoline inventories but draw in crude

- Weekly EIA US oil inventories -6451K vs -2200K expected

- Gold up on No. Korea concerns, but what are the charts saying?

- The FBI raided Trump campaign manager's home last month - report

- June US wholesale sales +0.7% vs 0.0% expected

- I have a rule of thumb when it comes to trading around nuclear war

- Canada building permits (June) +2.5% vs. -1.9% estimate

- US Q2 nonfarm productivity +0.9% vs +0.7% expected

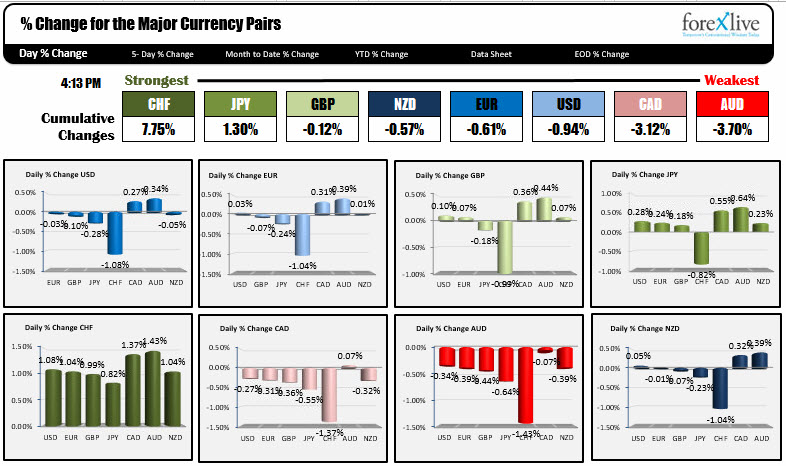

- Flight to safety into the CHF propels that currency higher. AUD is the weakest currency.

In other markets:

- Spot gold up $15.76 at 1276.72

- WTI crude oil up $0.44 to $49.61

- US yields are lower: 2 year down -1.2 bp to 1.338%. 5 year down -1.3 bp to 1.804%. 10 year down -1.6 bp to 2.245%. 30 year down -2 bp to 2.822%

- US stocks ended lower. S&P down 1 point or 0.04%. Nasdaq down -18.12 points or -0.28%. Dow down -36.64 points or -0.17%.

The days started 24 hours ago when President Trump talked how No. Korea "will be met with fire and fury like the world has never seen".

That helped to get the flight to safety ball rolling.

- Gold rallied. It is ending up about $15.

- CHF rallied. The CHF was the biggest mover of the day.

- Stocks tumbled. The Nikkei lost -1.29%. The German Dax closed down -1.12%. The French CAC was lower by -1.40%.

- US stocks opened weak, but ....darn... it is hard to keep the idea that nukes would be used.

Trump came out with "My first order as President was to renovate and modernize our nuclear arsenal. It is now far stronger and more powerful than ever before....",

However, before he could get out with Part II of the tweet which likely would have been something like "...and I am getting ready to hit the button and send one your way you SOB",had his phone wrestled away by Gen. Kelly who instead followed with a soft warning "...Hopefully we will never have to use this power, but there will never be a time that we are not the most powerful nation in the world!"

The US stocks did still open lower but as the time ticked by, markets calmed down and recovered a lot of the declines by the close.

Economically, the US non farm productivity numbers showed an increase better than expected with higher wages, but it had little immediate impact.

The oil inventory data was all over the place. The oil inventories showed a larger draw

down vs expectations, but the private data telegraphed that idea. Plus gas inventories showed a build. So oil waffled up and down but did not have a huge impact.

Wholesale sales (saying that seems redundant) rose by a greater than expected +0.7% with inventories up 0.6%. That too had little impact as well.

Feds Bullard and Evans - both doves - spoke about inflation being low and remaining low but Evans did give the nod to a winding of the balance sheet starting in September. If he can see, it, expect it in September. The comments had little impact.

In fact looking at most of the charts of the major currencies, the price action was a little down and a little up in the NY session - with most of the moves done before NY traders arrived.

What are the technicals saying to me for some of the pairs?

EURUSD

The EURUSD took a 57 pip tumble in a 10-15 period around 9:15 AM ET/1315 GMT. The fall took the price to new session lows, and - in the process - fell below the 100 bar MA on the 4-hour chart. That pushed the price back below the August 2015 swing low at 1.1711 (just an old remembered line). The low reached 1.1688. Twenty minutes later the price was back above the 1.1711 level and within an hour and 1/2, the price had retraced the entire move lower. In the new day the 1.1776 is the 200 week MA (the Asian high was 1.1763. The London high was 1.1761. The NY high was 1.1761). That level should attract sellers on a test. On a break, the 100 hour MA comes in at 1.1795. The 200 hour MA is at 1.1805 and the natural resistance is at 1.1800. Look for sellers to at least pause a rally there. On the downside, the 1.1711 remains a level to get and stay below if this pair's top is in place.

USDJPY

A picture tells the story for the USDJPY. The chart above shows how a lower trend line connecting lows from August 1 continues to attract attention (the last time in the last hourly bar). Yes, the line was busted.....twice. However, the re-establishing of the line says to me, buyers continue to like the level. What are the levels above that give more confidence for the upside? I like getting above 110.10-23. IF you want to know more about why, CLICK HERE.

GBPUSD

The GBPUSD went higher, went lower and is trading near the midrange, right around the 1.3000 level. The pair has trended lower since last Thursday. That move started after the more dovish BOE release, and was continued on Friday after the solid US employment statistics. Yesterday, the dollar buying continued after the better than expected JOLTS data. Those steps lower may have gotten a little ahead of itself. Hence the up and down pause today. What the consolidation today did accomplish was to get the 100 hour MA closer to the price. It is currently at 1.3044 and moving lower. Should the price and MA get test in the new day, look for sellers to lean against the level (with stops on a break above).

NZDUSD

The RBNZ just announced no change in policy and expect rates to remain on hold until 3Q of 2019 (we are in 2017). They did say that the NZDUSD needed to come down to reach goals. Nevertheless, the NZDUSD moved higher but stopped right at the 100 hour MA at 0.7370 and is trading down to 0.7348 currently. I guess you gotta love 5 PM ET rate announcements. Anyway Gov. Wheeler is ahead and the market will gauge how effective he is in telling traders that the currency is too high.

Below are the % changes of the major currencies vs each other. Good fortune with your trading.