We are accustomed to seeing Nvidia, Apple, and other tech giants basking in AI glory. But what if it’s only the tip of the iceberg? It seems so, as all analytics overlooked a sharp rise in Hewlett-Packard stock. Let’s examine what boosted the stock price by more than 10% and its connection to artificial intelligence.

For many, HP is synonymous with laptops, printers, and various computer peripherals, not usually seen as a leader in innovations. However, Hewlett-Packard's stock chart tells a different story. The company actively embraces new developments, as reflected in its significant earnings.

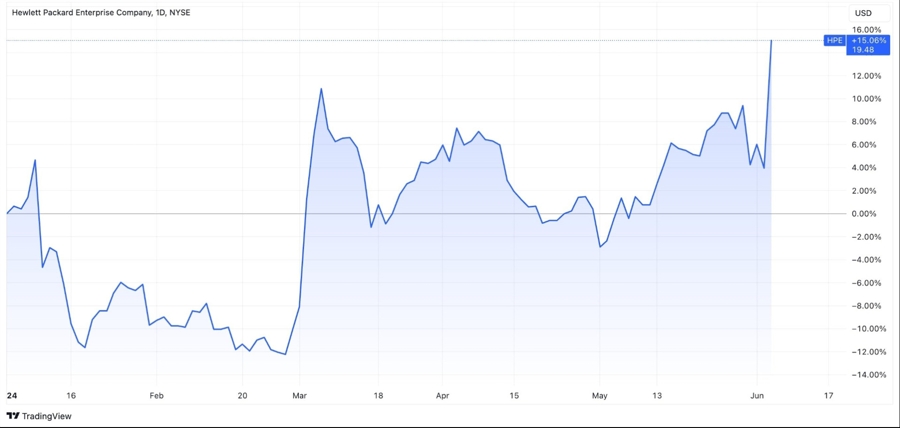

Hewlett-Packard shares have increased by 15% since the beginning of the year, outperforming Apple stock results.

Though a 15% increase might seem modest in the world of Bitcoin and Nvidia, it marks a 5-year high for HP.

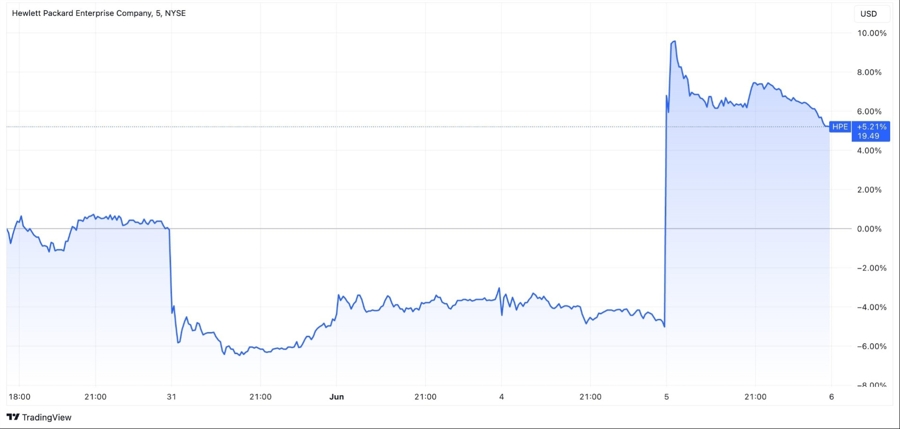

The latest price surge was driven by the company’s second-quarter 2024 financial results. HP Enterprise reported revenue of $7.2 billion, 5.6% above forecasts and 3% higher than the same period last year.

Earnings per share also exceeded expectations: 42 cents against the projected 39 cents, a difference of over 7%.

A significant part of these results is tied to the magical abbreviation — AI. Demand for HP’s AI servers and systems contributed significantly to the revenue, with server segment sales up by 18% compared to the previous year.

Among other factors boosting investor confidence in HP stocks is the company's acquisition of Juniper Networks, which builds complex business networks. Announced at the beginning of the year, this acquisition is expected to impact HP in the long run positively.

Following this report, analysts revised their forecasts. UBS raised the target price to $17 from $16, BofA Securities to $22 from $19, Bernstein to $19 from $17, Wells Fargo to $22 from $19, and Barclays to $20 from $14. Clearly, experts are in agreement. However, it's important to remember that they didn’t foresee such impressive financial results before, so you should always conduct your own research before making any trades.