Forex news for US trading on May 17, 2017

- Trump: No politician in history has been treated worse or more unfairly

- US household debt surpasses the 2008 high

- Paul Ryan: Congress will keep working on its agenda despite controversy

- Comey invited to testify in House on Wednesday

- Fed's Kashkari: Tackling asset bubbles with higher rates is a last resort

- SNB's Jordan: Swiss franc still overvalued

- Bruno Le Maire named French finance minister as cabinet revealed

- Canada March manufacturing sales 1.0% vs +1.3% expected

- Putin says Trump did not pass any secrets to Lavrov

- Here are the four finalists to be the next FBI director

Markets:

- S&P 500 down 44 points to 2357 -- worst day since Sept 9

- Gold up $22 to $1259

- WTI crude up 32-cents to $48.98

- US 10-year yields down 11 bps to 2.22%

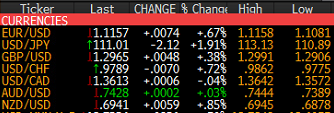

- JPY leads, CAD lags

You won't find a reason for those market moves in that set of headlines. It was all about what transpired earlier when reports surfaced about memos showing Trump may have improperly tried to ask Comey to kill his investigation of Mike Flynn.

As US traders arrived, S&P 500 futures were down just 14 points but what started out as worries turned into fears in a market rout that sent the index down 44 points.

USD/JPY fell more than 200 pips in the largest decline since July 2016. It wasn't a quick drop but a steady erosion as stocks and yields carved out lower lows. Along the way it broke the 55-day moving average and 111.00. In a week, the pair has gone from above 114 to below 111.

It was part of a broader theme where the yen soared. At first commodity currencies were hit harder then the US but that reversed and AUD & CAD finished even with the dollar. The New Zealand dollar gained 60 pips in a surprising gain despite pressure on the carry trade.

Hidden in all the talk about the yen and politics was that it was the fourth consecutive day of gains for the euro as it continues to break out. EUR/USD hit 1.1157 and climbed 75 pips to finish on the highs again.

Cable was choppy but is back on the doorstep of 1.30 and that will be a key level to watch in the day ahead.