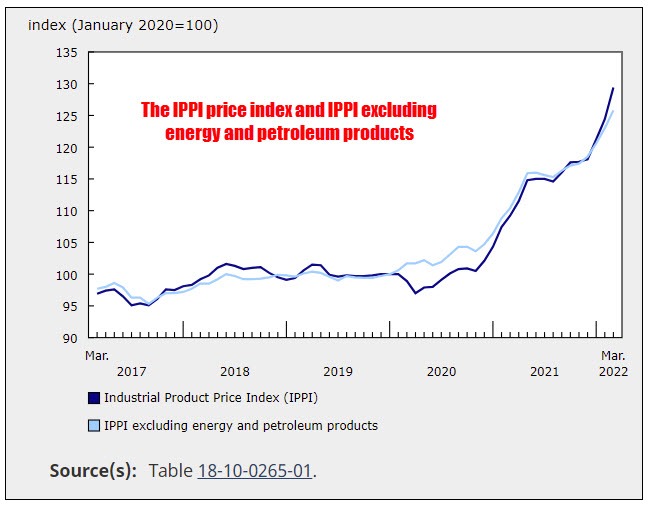

Canada IPPI data for March 2022 showed a gain of 4.0%.

- Prior month revised lower to 2.6% from 3.1%

- Canada IPPI year on year 18.5% versus 15.8% last month (revised from 16.4%)

- Raw material price index (RMPI) 11.8% MoM versus 6.4% last month

- Raw material prices YoY 42.7% versus 30.3% last month revised from 29.8%

I took a double take on the raw material price index increase of 42.7%YoY and 11.8% month on month. The industrial product price rises also under hefty. Russia/Ukraine war sent price is surging in the commodity sector

- The large gain in IPPI was the largest monthly gain since the series began in January 1956.

- The gain in IPPI was largely driven by refined petroleum products (+18.8% MoM). The gain was the largest on record (going back to January 2010). YoY the prices are up 65.7%.

- Non-ferrous metal products rose 9.2% (includes unwrought gold, silver, and platinum). Softwoods increase by 8.0% for the six consecutive monthly increase.

- The year on year gain was the biggest since December 1974

- For the raw material price index the gains were driven mainly by higher price for conventional crude oil. Excluding crude energy products the RMPI rose 6.8% monthly

- crude oil was up 20.2% in March which is the largest monthly gain since June 2020

- year-over-year conventional crude oil prices rose 80.0%

- crop products were up 14.0% month over month and are up 47.3% year-over-year with canola up 29.5% and 69.4% year on year. We also increase by 12.8% and 63.8% as Russia and Ukraine war increases that commodities price.

The gains will keep the Bank of Canada on a tightening path in an attempt to slow down growth/demand, although central bankers are fighting inflation were caused partly/largely by the Russian/Ukraine war which has increased energy and other commodity prices.