AUDUSD kicked down through 0.7300 of worsening Chinese manufacturing

The Aussie seemed to have found a comfortable level between 0.7350 and 0.7450 over the last few days. Sometimes a currency needs an extra hand to push it to new levels and the newly sponsored Caixin Markit manufacturing PMI did just that. As it dumped further into contraction so AUDUSD dumped further also

Traders report aggressive interbank sellers amongst others which took out stops at 0.7320 and 0.7300 and that sent the pair down to the lowest Jan 2009. We stopped right on support at that level of 0.7270

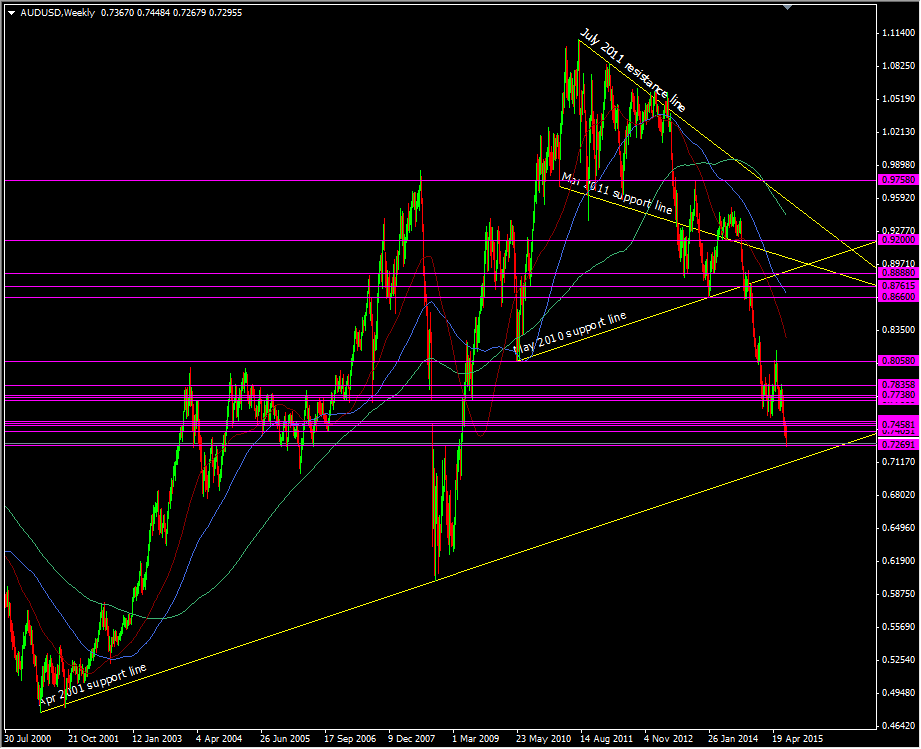

AUDUSD weekly chart

The kick below 0.7350 and 0.7300 has opened the way towards the Apr 2001 support line which comes in around 0.7120. The broken levels can now be expected to carry resistance on any move back up and 0.7300/10 already is

One of my first targets for this move following the break from 0.7500 was this support level at 0.7270. I closed out a bit more of the position at 0.7280 and will now look to either reload on any decent bounces, or see if we can punch through to my ultimate target at 0.7120. If we get there I'll see what the lay of the land is like to either get out and play a long on the level, or to play any break and add more shorts.

So far this trade has been a very good one technically and it's running well with the fundamentals. While they point the in the same direction there's no reason to fight it