The first RBA meeting for 2018 is today, announcement and statement due at 0330 GMT

Earlier previews:

- Reserve Bank of Australia meet today - previews

- RBA meet this week - preview

- Australia - RBA meet for the first time in 2018 next week - preview

- AUD traders - RBA meet this week, first for the year - preview

Ahead of the RBA today, data due:

- Australia data due today ahead of the RBA announcement - more retail sales previews

- Australia data due today ahead of the RBA announcement - retail sales previews

- Australia data due today ahead of the RBA announcement - trade balance (Dec.) previews

This now via Westpac:

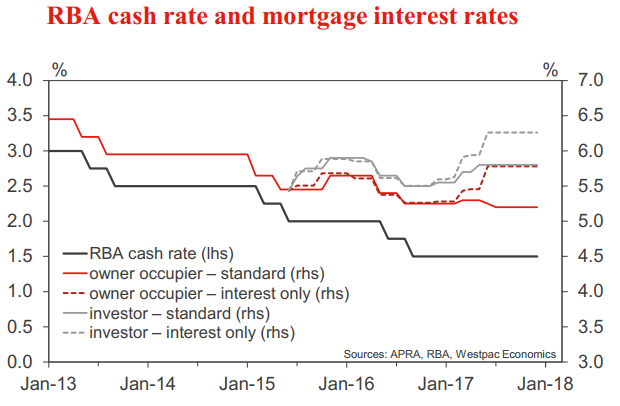

The RBA left interest rates unchanged throughout calendar 2017, Governor Lowe noting in his final speech of the year that: "the continuing spare capacity in the economy and the subdued outlook for inflation mean that there is not a strong case for a near-term adjustment in monetary policy".

We expect the RBA to leave rates unchanged at its February meeting.

Developments over the summer hiatus have been mixed with the Q3 national accounts disappointing but more positive news around global conditions, labour markets and confidence.

- Inflation remains subdued, with latest figures showing core inflation running at a 1.6% annual pace over the second half of 2017.

- There is also no new information around the Bank's key areas of uncertainty - the impact of lacklustre consumer demand; the extent to which weak labour income growth continues; and the risks around household debt.

- We expect consumer weakness to persist in 2018, leading the RBA to again leave rates on hold all year.

- We expect a 0.4% rise in the private sector Labour Cost Index for the December quarter.

- Wage growth has been running at the same quarterly pace for the last couple of years, aside from the 0.7% rise last quarter, which included the equal pay settlement for aged and disability care workers.

- We have no evidence to suggest there was a stirring of wage pressures in the December quarter.

- Indeed, the latest Westpac-McDermott Miller employment confidence survey found fewer workers reporting a rise in earnings over the last year.

- The Quarterly Employment Survey (QES) suggests a stronger rate of growth in hourly earnings. However, this measure is affected by changes in the composition of jobs.

---

This via Barclays:

- For the RBA cash rate, after a brief hiatus in January, we expect the central bank to take its cues from the inflation print and ongoing strength in the labour market, amid improving signs of consumption, to emphasise that the economic recovery remains on track