When will the Fed rate cutting cycle start?

That's the preoccupation of market participants and economists at the moment. We're all waiting for the economic data to roll in and commentary from Fed officials but that hasn't stopped the guessing game.

Markets are fully priced for a June 12 rate cut but economists aren't so sure.

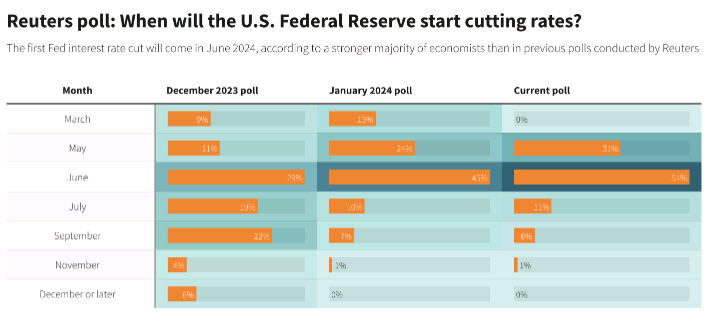

The latest poll of 104 economist from Reuters sees a Q2 cut coming but a slim majority now see the June 12 meeting as the base case, up from 45% previously. That's largely because those looking for an earlier cut have now pushed back expectations.

No economists now see a March cut compared to 12% before while 31% see May compared to 37% for March/May previously.

What stands out to me about this poll is the cluster in the May to July period. Does it really matter when the trigger is pulled?

Here's Deutsche Bank today:

We have been writing for some time that the precise timing of a Fed easing cycle is not that relevant for the dollar. Instead, what matters is terminal rates and the cumulative amount of cuts that are priced versus other central banks.

They argue that higher Fed terminal pricing should support the dollar but the market clearly isn't ready to contemplate that yet. That may be because of US political risks or it could be because more data is needed and it's tough to price in a new higher-Fed funds rate regime without compelling evidence.