Via Bloomberg, shake the PMI's wake the dragon?

Chinese stocks have been subdued lately. In part this has been fatigue as the Us-China trade negotiations oscillate every few days. It's on, it might be off, it's on, etc etc. Until Friday last week the Shanghai Composite only moved around 1% up or down for three week.

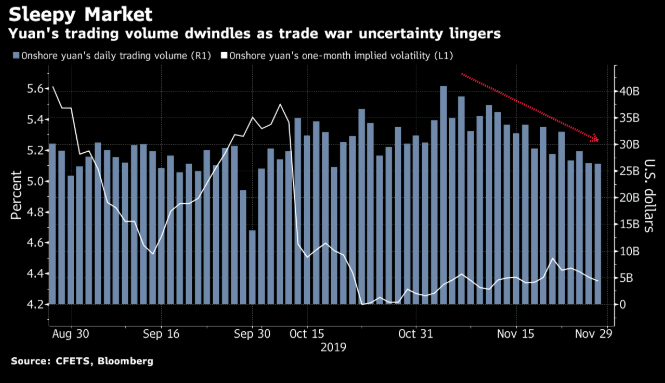

The Yuan has also seen a fall in volatility as volumes fell last month and has now hit the lowest level since mid-October on Thursday last week.

Chinese PMI's to re-energise markets

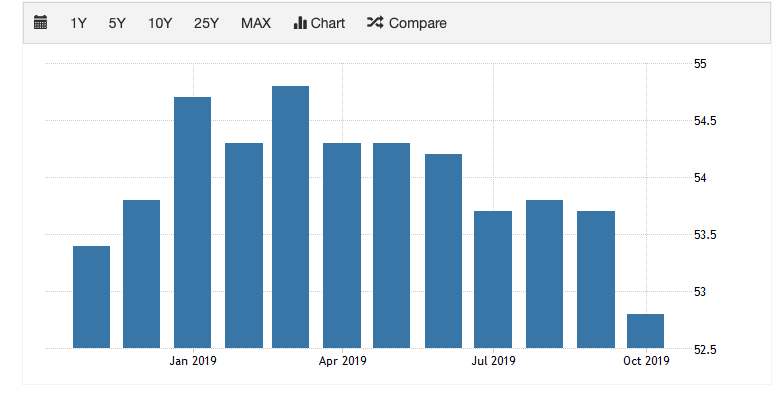

According to Bloomberg's Market Live blog the manufacturing PMI's had been expected to signal contraction this month and services PMI were expected to show a small pick up for October. Note that the Caixin manufacturing data out is the private surveys of smaller to medium Chinese businesses. The recent run of services PMI data for the Caixin data out on Wednesday has shown a steady decline since May this year. So, a beat there and we will have a full dose of good news from the latest Chinese PMI data.

The Caixin manufacturing data has shown a pick up in the last couple of months. October saw a beat of 51.7 vs 51.0 expected with both output and new orders expanding at steeper rates. The official manufacturing PMI release showed an expansion for the first time in 8 months at 51.8 vs 51.5. The services data showed a beat too at 54.5 vs 53.1 showing the highest reading since March. Any surprises to the downside with the PMI's would have raised alarm bells. This surprise to the upside will alleviate nerves. The immediate response has been a buoyant Asian equity market. The Nikkei is up +1.01%. the Hang Seng +0.42% and the Shanghai Comp. +0.13%. This is a positive risk development, but may make China slightly more robust in US-China trade negotiations with the US in a similar way that stronger US data hardened President Trump's hand.