Choppy up and down price action

The price action this week has taken the GBPUSD higher with the meat of the move taking place on Monday. The rest of the week has seen choppy up-and-down price action.

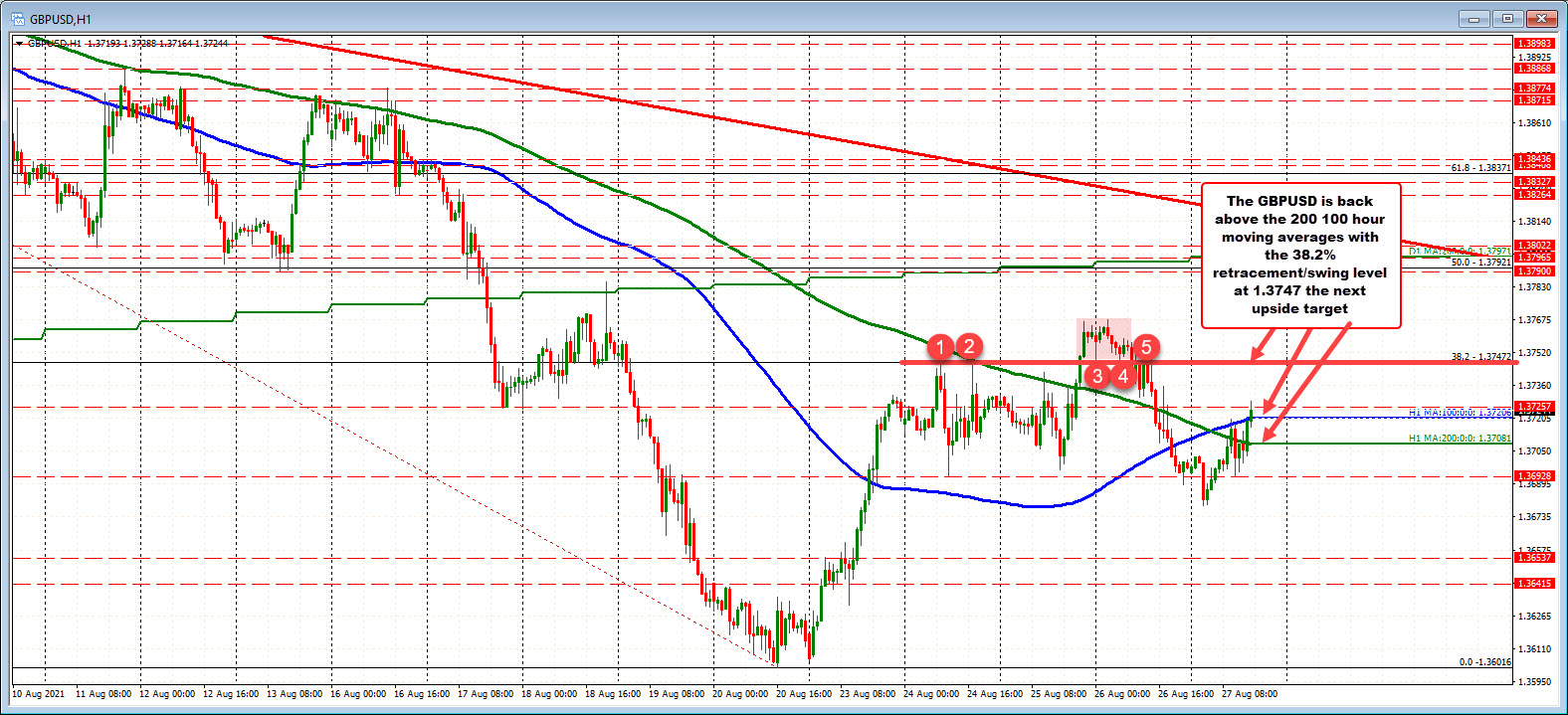

Reviewing the week, the GBPUSD moved sharply higher on Monday in a trend move up. On Tuesday the price action chopped up and down, closing near unchanged. Wednesday saw the continuation of the up and down choppy price action before moving higher to new week highs in the NY session. A move above its 200 hour moving average was the catalyst for the run to the upside

On Thursday the price gains from Wednesday could not be extended, and the prices started to drift back to the downside. The pair fell back below its 200 and 100 hour moving averages (blue and green lines in the chart above)

Finally today, the pair has corrected higher, but not without some intraday moves down and back up and back down and now back up. The pair just moved back above its 100 hour moving average at 1.37206. Earlier it traded above and below its 200 hour moving average at 1.37081. Those moving averages are now support/risk defining levels

Overall the price is higher from last week's levels but has started to center above and below the 100 and 200 hour moving averages.

As always the price can remain above the moving averages, the technical bias remains positive the 38.2% retracement of the move down from the July 30 high comes in at 1.37472. That was also swing highs from Tuesday's trade and swing lows from yesterday's trade before moving lower. That retracement is the next upside target on further momentum.

Needless to say risk is increased as the market awaits the Fed chairs comments. Most of the Fed presidents have been more hawkish, looking for taper to start sooner rather than later. What will Powell say and more importantly what will the markets reaction be?

Despite the strength of Fed officials lining up on the sooner rather than later/let's get the ball rolling camp, yields are higher but not near recent swing high levels. The tenure yield is up at 1.33%. That's down about one basis point on the day. The US dollar is tilting to the downside.