US yields are moving higher and it is leading to a back to the upside in the US dollar:

- 2 year yield is at 4.064% up 5.6 basis points.

- 5year yield is at 3.566% up 4.7 basis points

- 10 year yield is at 3.448% up 3.4 basis points

- 30 year yield is at 3.635% up 0.9 basis points

Looking at the major currencies :

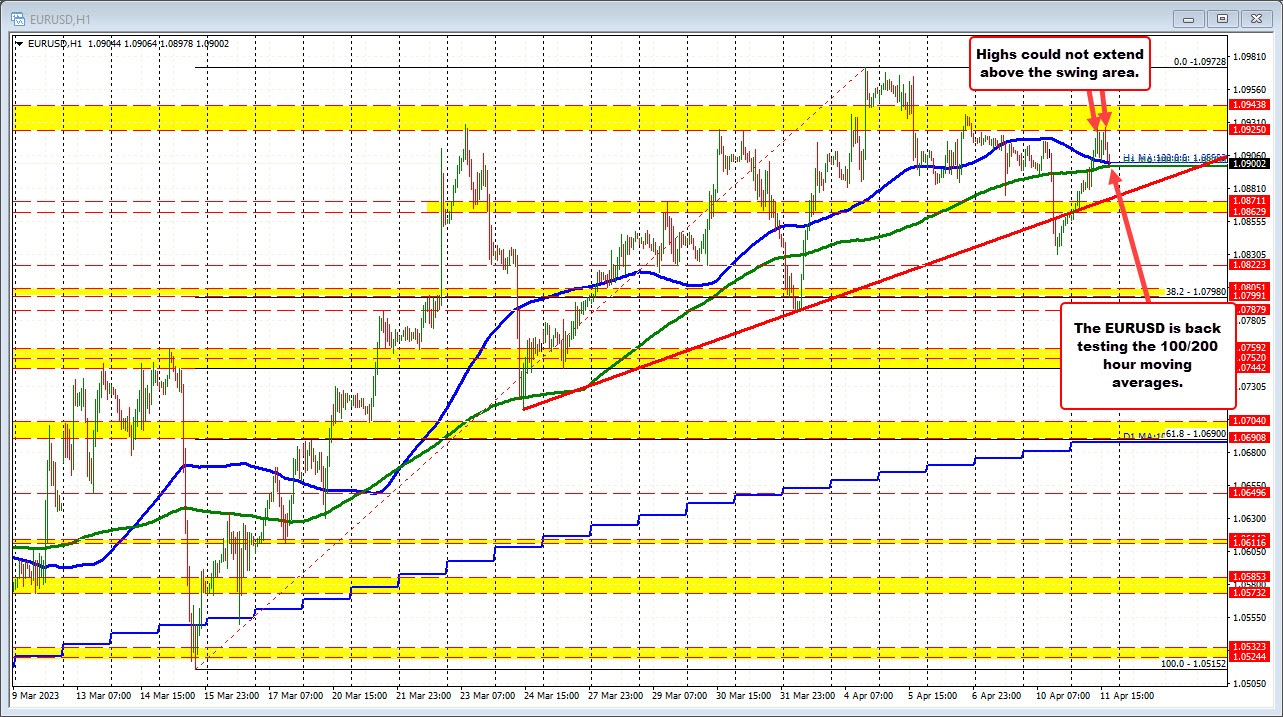

- EURUSD: The EURUSD is reversed back to the downside and is retesting its 100 and 200 hour moving average is near 1.0898 – 1.0899. The current price trades at 1.0900. It will back below the moving averages would tilt the short-term bias back to the downside. The high prices today stalled within a swing area between 1.0925 and 1.09438.

EURUSD is back testing the 100/200 hour MA is near 1.0900

- USDJPY: The USDJPY has moved back above its 100 day moving average 133.399 and looks toward the 50% midpoint of the move down from the March high at 133.769. The high price for the day just reached 133.706

USDJPY moves back above its 100 day moving average

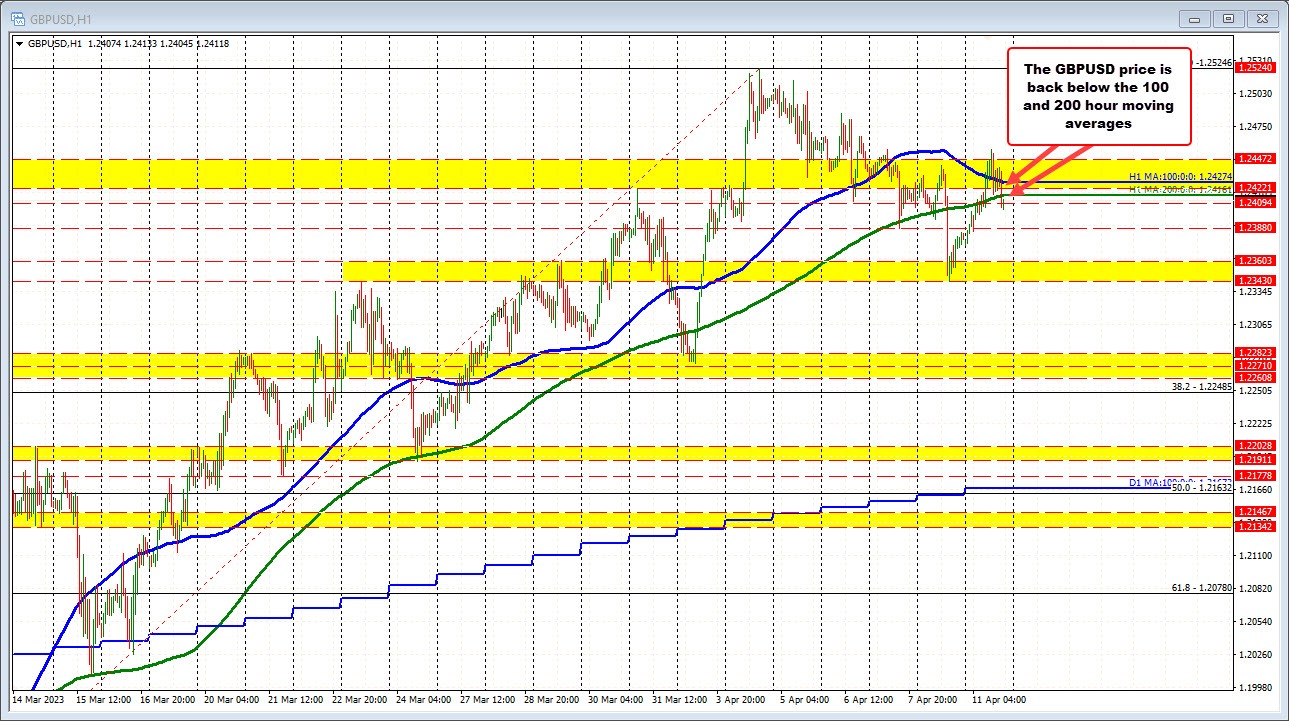

- GBPUSD: The GBPUSD has moved below its 100 and 200 hour MAs at 1.24274 and 1.24161 respectively. The buyers had their shot and those buyers tried to hold support in the US session, but sellers have cracked the price back below the moving average levels tilting the short-term trading bias back to the downside.

GBPUSD falls below the 100 and 200 hour moving averages