RBA meeting today, announcement and statement due at 0330 GMT

This February meeting is the first of 2018 (January was a holiday) and there is plenty for the Bank to be mulling. Earlier previews:

- Reserve Bank of Australia meet today - more previews

- Reserve Bank of Australia meet today - previews

- RBA meet this week - preview

- Australia - RBA meet for the first time in 2018 next week - preview

- AUD traders - RBA meet this week, first for the year - preview

Also, ahead of the meeting today there will be December data due from Australia:

- Australia data due today ahead of the RBA announcement - more retail sales previews

- Australia data due today ahead of the RBA announcement - retail sales previews

- Australia data due today ahead of the RBA announcement - trade balance (Dec.) previews

Via National Australia Bank:

While markets were not expecting the RBA to change its cash rate at Tuesday's board meeting, Wednesday's unsurprising CPI print, and the unemployment rate remaining elevated in December, has cemented that belief.

- What will be keenly watched is whether any other developments will change the RBA's view on the economy and policy going forward.

As such, markets will be pouring over changes in the decision statement, Governor Phil Lowe's speech on Thursday, and the Statement of Monetary Policy (SoMP) on Friday, which include updated forecasts.

- The Governor's speech will probably not be market moving given the audience and the SoMP the next day.

In its last SoMP, the RBA indicated ongoing uncertainty about the degree of slack in the labour market, inflation and consumption.

- While recent labour market data confirms strong employment growth over 2017 (+400 jobs!), unemployment has remained stubbornly elevated, at 5.5%. This rate is above the RBA's estimate of the NAIRIU, and is indicative of ongoing slack in the market. However, should participation rate stabilise, the unemployment rate would begin to fall, something we are looking for to occur in the coming months.

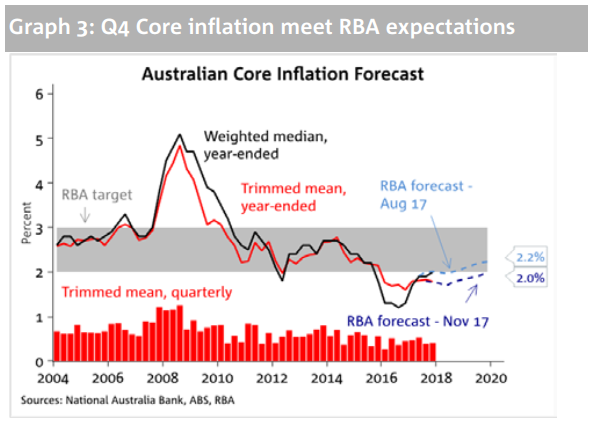

- The recent core inflation print of 0.4% q/q for the December quarter, brought trimmed mean inflation to 1.8%. While this number remains below the lower edge of the RBA's target of 2-3%, the RBA's forecasts show that the print was broadly expected by the Bank, and unlikely to significantly change the RBA's outlook. Inflation has stabilised and is gradually trending towards the RBA's target.

- As further strengthening in the labour market occurs, we expect inflation to rise to be comfortably back within the band over the medium term.

This via RBC:

This is the first board meeting for 2018 following the usual January hiatus. There are three key developments since the board last met in early December.

- Firstly, global activity data continue to highlight momentum, with G7 central banks continuing to shift toward the removal of policy accommodation.

- Secondly, domestic employment data and key business surveys have been strong although inflation remains modest.

- Thirdly, AUD/USD has appreciated by ~6.5% and ~3.5% on a TWI basis.

On balance, these developments point to upbeat and positive communication from the RBA ... in line with the global central bank rhetoric, although there may be some caution around the currency.

We expect no substantial changes to the key macro forecasts, which should continue to assume an eventual return to above-trend growth and within target inflation. In itself, however, this is noteworthy given the constant downward revisions to overly optimistic growth forecasts. No change to GDP forecasts would be a positive development.

This via HSBC:

The RBA has, so far, been patient about waiting to see clear signs that wages growth is lifting before it considers raising its cash rate. We expect this to continue for the time being. We see the RBA as unlikely to change its domestic forecasts when they are published next week. The tone of the RBA's approach is likely to be similar to that conveyed by the Governor in a speech in November 2017 when he stated that 'if the economy continues to improve as expected, it is more likely that the next move in interest rates will be up, rather than down ... [but] ... the subdued outlook for inflation means that there is not a strong case for a near-term policy adjustment'. On the positive side, the RBA is expected to point to the ongoing improvement in global economic conditions, which is supporting commodity prices, Australian exports and may filter through to local business investment. On the downside, the RBA is expected to point out that the recent lift in the AUD may be somewhat unhelpful for the growth and inflation outlook, although we do not think it will tangibly affect the RBA's central forecasts. Importantly, another factor that is likely to support the RBA's patient approach to lift-off is that the housing market has continued show signs of cooling over recent months On the margin, this may allow the RBA to be even more patient about lifting its cash rate from its current historically low level.

---

ps. More to come this week from the RBA:

- Thursday (February 8) Governor of the Bank Philip Lowe speaks at the A50 Australian Economic Forum dinner

- Friday (February 9) the Bank publish its first Statement on Monetary Policy for the year