First quarter (January - March) CPI from Australia. Official inflation is out only once a quarter (we do get a good monthly guide from a private survey)

- Data is due at 0130GMT

'Headline' inflation

- expected is +0.5% q/q, prior was +0.6%

- For y/y, expected 2.0%, prior 1.9%

Core ('trimmed mean' - the measure the RBA pays most attention to, their target band iis 2 -3%)

- expected 0.5%, prior 0.4% q/q

- y/y, expected 1.8%, prior 1.8%

Also a core indicator - 'weighted median'

- expected 0.5%, prior was 0.4% q/q

- expected 1.9%, prior was 2.0% y/y

Links to earlier previews posted:

- Australian inflation data due today - preview

- Heads up for AUD traders - Australian CPI data for Q1 - preview

- What will guide AUD/USD this week (event risk for the Australian dollar)

- Australian Q1 inflation data due this week - preview

Another preview now, this via National Australia Bank :

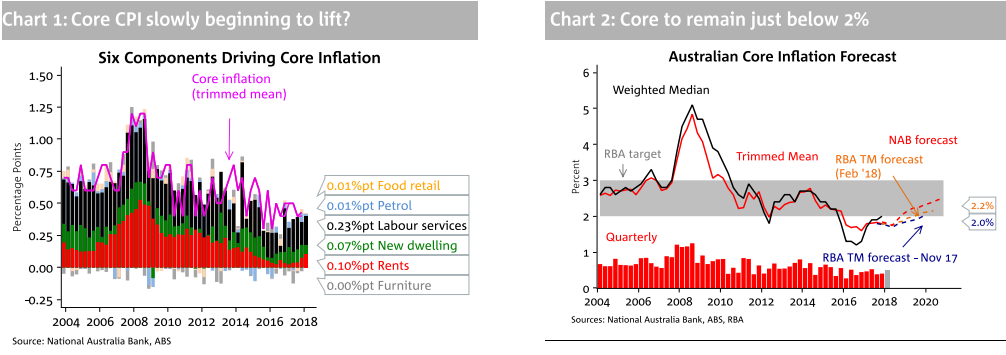

NAB is expecting a rise between 0.4 and 0.5% q/q (1.9% y/y), close to consensus (0.5%q/q, 1.9% y/y).

- For core, NAB expects 0.5% q/q for the trimmed mean and 0.4% q/q for the weighted median (mkt: 0.5% q/q for both).

- we believe there are mild upside risks to our bottom-up forecast from tradables inflation given rising global inflationary pressures

it is core inflation that matters for the RBA as a short term indication of trend

- An outcome of around 0.5% for the core measures of inflation is unlikely to give the Bank any reason to lift rates early given benign wages, or change its outlook for inflation.

- Another core inflation print in the 0.4 to 0.5% q/q range keeps core inflation stable and broadly in line with RBA expectations ... but again a little below the bottom of the RBA's 2-3% target range

The Bank has made it crystal clear in its recent Minutes that the Board believes it is "more likely that the next move in the cash rate would be up, rather than down". Given the RBA's communication, rising global inflationary pressures and indications that the unemployment rate should decline, it is very likely that this quarter's CPI print sees the Board remaining in its current "wait and watch" setting. Even should inflation surprise on the downside, by far the most likely outcome from this quarter's CPI print is that the RBA remains on hold.

Going forward, the outlook is for inflation to remain broadly quite low. NAB's models point to gradual rises, while key indicators are suggesting the labour market is tightening, and hence wages should begin to rise. Note there has been some anecdotal evidence suggesting that intense food-retailing competition may be waning - we will be keeping a watch for this in Q2.

---

This via:

RBC:

We expect both the headline and core rates to remain well behaved consistent with persistent sub trend growth and ongoing labour market slack.

- We expect headline CPI to have risen by 0.6% in Q1 underpinned by a firmer housing component reflecting higher electricity/utility prices in Victoria and seasonally stronger education costs.

- Annual headline CPI should edge higher to 2.1% after several years of sub 2% (with the exception of Q1 2017).

The key core measures are likely to remain more subdued and we expect the average of the trimmed mean and weighted median to be 0.45%.

- This would imply y/y core CPI edging marginally lower to 1.8% and marking the ninth consecutive quarter of sub 2% core inflation.

There is little in the individual CPI components or the broader macro drivers to suggest any pick up in core inflation in early 2018, though tradeables may have some upside on higher oil prices. Indeed, the risk to our core CPI forecast is slightly to the downside. We also like to keep an eye on other key core measures including market sector ex-volatiles which has been running at barely 1% y/y for the last 2 years.