Getting to know the Holy Grail strategy

Holy Grail is one of the strategies described by Linda Raschke and Laurence Connors in their book "Street Smarts". The name of the strategy is mocking because it is super simple. It suits timeframes from M1 to MN and any instrument in Forex, futures, and stock markets.

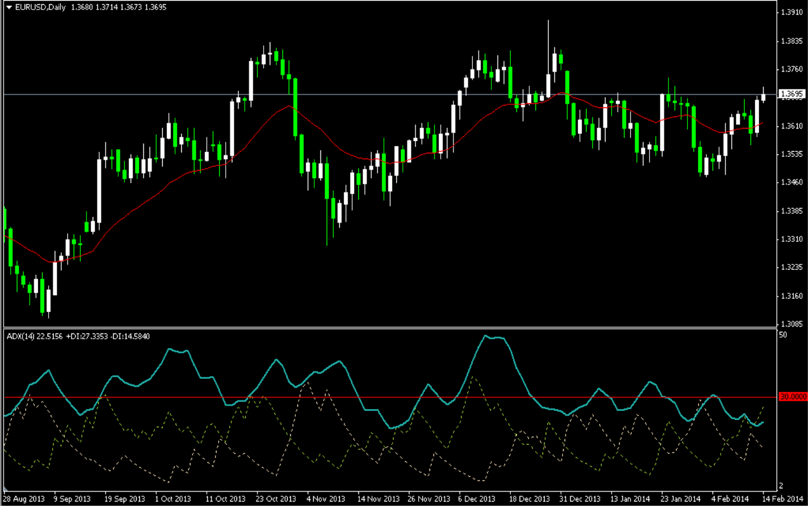

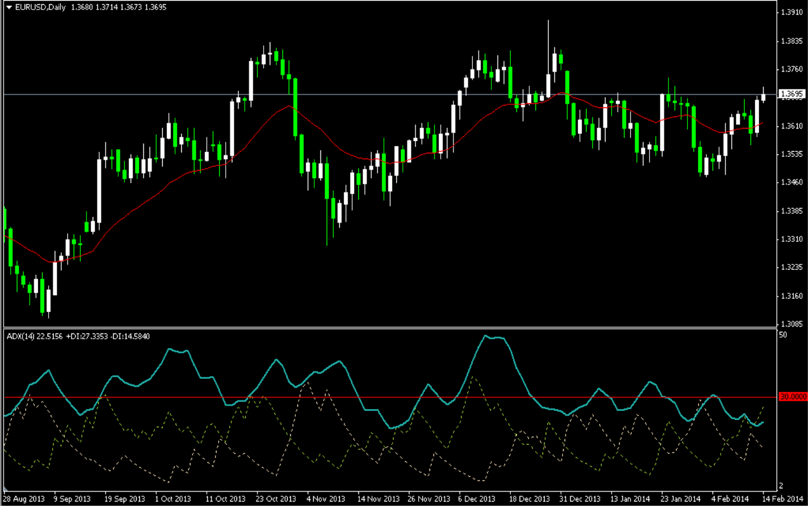

Holy Grail desktop

As you can see, the desktop of the strategy consists of one simple Exponential Moving Average (20), applied to Close prices, and the ADX indicator with standard parameters and the marked level 30.

The idea of the strategy is that ADX shows the strength of the trend on a certain period. Some traders think that a reversal of this indicator top-down signals a trend reversal but this is not always true, the correctness of this idea depends on whether we are trading in a flat or trend. We do not care about flats, so this is what the EMA (20) is necessary for: its slope shows the direction of the current trend.

A signal to buy

A signal to buy by the Holy Grail forms when ADX rises above 30, following the growth of the price; after that, the price must pull back to the EMA (20) and touch it. When the candlestick that has touched the EMA closes, place a buying order above the high of the candlestick with the initial Stop Loss below its low. As for the Take Profit, place it slightly below the highest local high that formed after the price pulled back to the EMA (20). If the next candlestick does not trigger the buying order, and its high turns out below the preceding candlestick, place the order above this candlestick. And if its low renews the low of the previous candlestick, place the SL below the former. Of course, ADX will be falling alongside the price. However, for the signal to be valid, ADX must not fall below 30.

An example of a buying signal and placing trading levels:

A signal to sell

A signal to sell by Holy Grail forms when ADX rises above 30, then the price falls, and then corrects to the EMA (20), touching it. ADX must not fall below 30. Place a Sell Stop below the candlestick that touches the EMA and an SL - above its high. If a candlestick appears with higher low and high, change the parameters of the order for these new ones. Place a TP slightly below the lowest local low after the correction of the price to the EMA (20).

An example of selling and placing levels by Holy Grail:

Money management by Holy Grail

Choose a money management system depending on how aggressively you trade. When the price comes closer to your TP, try dragging the SL closer to the new price action, relying on your experience. Or do not do it.

An example of trading without moving the SL:

As long as trading by Holy Grail implies using pending orders and suits various timeframes, it will be comfortable for those traders who do not have a constant access to the terminal or cannot keep an eye on it long.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex