An in-depth look at Elliott Waves

In short, the answer is yes!

Anyone involved in the financial markets should dedicate some time to learn Elliott Wave analysis.

But before we go into the fun stuff, let's start with some basic background information.

What Are Elliott Waves?

Elliott waves are based on the work of Ralph Nelson Elliott. Elliott was the first person to discover a relationship between the movement of prices in the stock market and mass psychology.

His work, "The Wave Principle", was published back in 1938.

For the most part, Elliott looked at how patterns in data changed gradually over time. And it turned out that the movement, or "waves", of the markets reoccurred too often in price data to ignore.

In fact, they appeared so often that Elliott established several repeated "patterns" that we can use today to project the larger path of price development.

How Accurate Are Elliott Waves?

Right now, most of the prediction methods currently used in the markets aren't accurate.

In reality, it's very difficult to predict price changes with a reasonable degree of accuracy - especially when you're looking at several different data sets.

However, with Elliott Waves, all price history can become a fractal tool to predict future patterns or even the price itself. Therefore, applying Elliott Waves is a great place to start.

But there is a very important caveat - Elliott Wave analysis is only accurate if done correctly

Most of the hard work has already been done by Elliott: observe the markets, find repeated patterns in them and extrapolate that information in a book.

And now, after about 70 odd years of controversy, we can finally use his theory to predict prices of all asset classes, and even economic cycles.

All you have to do is learn all the variations of the Elliott wave patterns, how they combine with one another, and then practice, practice, then practice some more.

The Biggest Flaw of Elliott Waves

Assessing future price probabilities is the main goal any Elliottician should be aiming to achieve; nothing more.

Those who for years misunderstood how EW can be used in practice formed something of an army against it for its subjectivity. However, they most likely never used the patterns/waves correctly because they had too many alternate interpretations drawn based on their own preferred count, and they ended up giving up.

But those who truly understand Elliott Waves and the non-linear nature of the financial markets know that the answer to the critics of EW is always that it is precisely this subjectivity that is EW's greatest strength.

How can one even suggest that knowing the high and low probability wave counts can be bad for trading?

Are Elliott Waves A Reliable Way to Make Money?

Elliott Waves are not a reliable way to "make money". Actually, it's doubtful whether there even is a "reliable way" to make money in the financial markets.

As with every other trading strategy, trading indicator, or a trading system, Elliott waves are indeed very subjective to a beginner trader's interpretation. Hence, practice is so incredibly critical to applying Elliott waves successfully.

So, if you're not prepared to spend countless hours looking at charts, identifying patterns, and counting waves, this is not for you, and an edge should be found elsewhere.

But if you are a determined rising Elliotician, the best way to be sure of gaining an advantage in any trade is to develop the ability to predict where you can buy, where you can sell, where you can wait and where you can jump to another chart.

This is where Elliott waves are different to an indicator or to a trading strategy; they make you, the trader, very predictive. And they always allow you to have a backup plan; the alternative scenario.

The Real Elliotician's Strength

The alt count is not connected to changing charts, looking at other asset classes or turning the PC off due to uncertainty about one's count. It is simply another wave count.

That said, it's not just any view based on observation. It is the second most probable count next to the main scenario. So, not as subjective when one applies the probabilities on all counts, we might add.

And that's what makes EW very interesting. Because even if one of the counts doesn't work, the second, or any other count for that matter, most likely will. Which is what gives traders a much-needed trading edge.

The truth is that while any trading strategy can return profits to some, they can turn out to be way more costly and risky in reality if traded without Elliott Waves. And, yes, you can still apply Elliott Waves anytime and on any chart, and in combination with your existing trading strategy, creating an even greater edge.

The Easiest and Most Important Patterns to Learn

Although one can argue that Elliott Wave are complicated and time-consuming to learn, the easiest way to start is by doing it one step at a time.

And step one would be to start with corrections because impulses are very easy to spot. In addition, corrections are followed by meaningful progress in an impulse.

According to EW, any correction can only be followed by a counter-move, which can either be an impulse or another correction. Without the ability to identify a correction, an impulse can be expected, a breakout of a resistance or a support zone, or even a reversal at the exact wrong time and place.

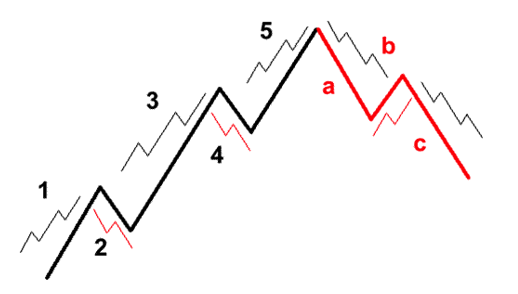

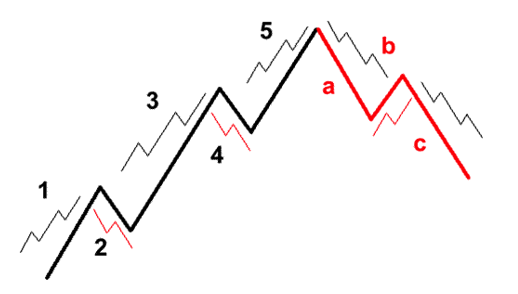

Would you really want to enter a trade against a clear pattern? Let's draw up a chart to clear the confusion.

What an Elliotician would do in the above scenario would be to enter a short trade the moment wave (a)'s top would be penetrated, with a stop at wave (c)'s top, and exit at wave (a) start - and that would still be conservative.

Although it could turn out to be an internal structure with deeper corrections allowed, the Elliotician knows that this is a correction in a 5-wave downside move in the larger timeframe. So, the moment the correction ends or is expected to end, the Elliotician gets his game-plan in action.

On the contrary, a trader with no EW knowledge would probably enter a long position at the local resistance breakout, thinking that a reversal at the lower swing low has incurred. And needless to say, the trade would be a losing one.

So, as the above example illustrates, you can see how powerful Elliott Waves can be and how identifying a simple correction can save you from bad trades.

Is Elliott Wave A Good Strategy For Beginner Traders?

Elliott Wave analysis and its application is not a strategy.

It's a highly predictive supplementary tool every serious trader should consider adopting, primarily to protect their accounts from bad trades, and then to make gains.

The fun part starts when you start ratio analysis use Fibonacci extensions to identify entry, take-profit and stop-loss levels.

When you finally see for yourself how the channeling this technique can often project a price in time and with dramatic precision, do not hesitate to join our responsible trading community at Orbex.

In the meantime, our award-winning research

department at Orbex is here to support you through your Elliott

Wave journey with daily EW analysis & trading opportunities uploaded to our

YouTube channel and blog.