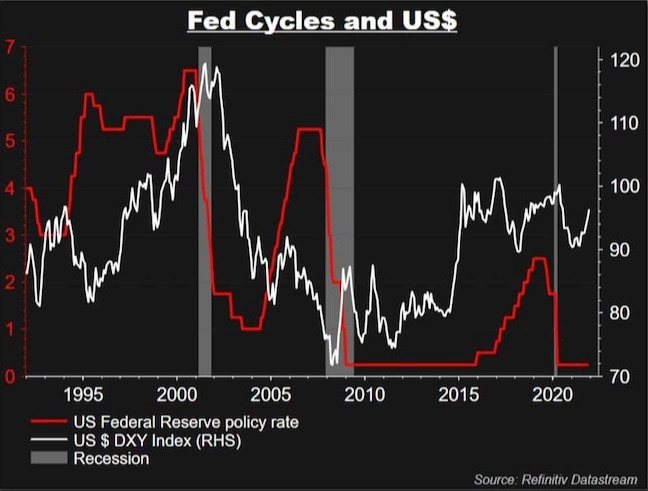

At the beginning of last year almost everyone was sure the US dollar would keep losing strength, but since June it has done exactly the opposite. The question on everyone's mind now is whether it will continue to appreciate or not. In my opinion, it won't, and I'll try to explain this by looking back at the last five cycles of rate hikes by the Fed and how the dollar reacted before and after them.

Below you can see on the chart how the USD reacted.

When 2020 started, no one expected a rate hike, but the Fed's position changed, and the market reacted in anticipation which strengthened the USD. Normally, when central banks raise interest rates, currencies tend to appreciate, but the dollar reacted differently in past cycles because the rate hike expectations were already priced in. This is one of the best examples of buying the rumour and selling the fact.

We also need to take into consideration that the USD is not alone in the market and that other major central banks like the BOC, BOE etc have also signalled rate hikes and this could hold back the USD. There are also a lot of discussions about the ECB potentially raising the rate, even though at this point such a move seems far away. But if it happens, the SNB, which generally lags behind the ECB, would also likely react.

Societé Generale

analysts expect at least 3 hikes from the Fed in 2022 and 2023, a peak at

2-2.25% in early 2024 and a USD 2-2.5trn balance sheet run-off by the end of

2024. In my opinion, under current circumstances we could have 3 hikes in 2022

alone, and if inflation continues to exceed expectations, some analysts believe

we could even have 4.

In conclusion, I think this year could be a neutral one for the USD. I don't

think it will continue to appreciate, but I don't think it will necessarily

depreciate either. It could rather take a neutral stance as investors reduce

their long positions.

In an article on its website, the Federal Reserve Bank of St. Louis says that a theory "predicts that a rate hike in the U.S. should depreciate the U.S. dollar," but that in reality "a higher interest rate may have very little or no effect on the exchange rate, given the strong empirical support of the random walk behaviour of exchange rates in the short run."

In other words, there are also various aspects that can influence the USD aside from interest rates.

From a technical perspective if we look at the Weekly chart on DXY we can clearly see how the USD has appreciated since the market started anticipating a rate hike. It now looks like it started a correction after rejecting the resistance at 95.85 and it's heading to the next support level at 94.50. If broken, the next support is at 93.00. Those will be important levels to monitor, along with fundamentals, to see how the USD will react.

On the upside the next resistance on the Weekly chart is at 98.00.

This article was written by Gina Constantin.