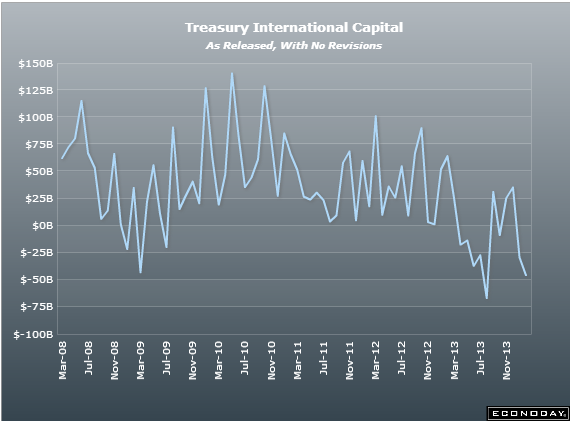

- Prior (inc swaps) revised to -$39.2bn

- Ex-swaps -$45.9bn vs -$29.3bn revised to -$28.0bn

- Foreign buying t-bonds $17.86bn vs -$3.4bn revised to -$0.13bn

- Overall net capital flows -$119.6bn vs -$16.6bn revised to -$13.0bn

- China Treasury holdings $1.269tn vs $1.317tn in Nov

- Japan $1.183tn vs $1.186tn prior

So it looks like some diversification going on with overall flows, mainly from private investors, shedding $119bn. Foreign demand for long term secs continues on the downward path seen through the end of 2013.