People will look back at the current period in economics and be aghast that policymakers were fretting about inflation.

This is an age of unprecedented technological innovation aimed at driving down costs and boosting productivity along with totally free movement of capital and production to wherever employees will work for the least. And the private-sector organized labor movement has been obliterated.

Anyone worried about any developed-world inflation is out of their mind.

There are two power structures in Western economics that have been shaped by history into a perfect storm of stupidity.

- Germany, where some kind of mass-psychosis, Weimar Republic, WWII-guilt has manifest itself into near-biological fears of "zeee inflation".

- The United States, where current policy-makers came of age in the Volcker era. Economists build mental monuments to him and associate the following 20-year Golden Age in the US economy to his breaking the back of inflation. They want to be him.

They're generals fighting the last war.

German children playing with worthless money

There's one Former Fed policymaker who gets it. Who sees the enemy at the gates -- 84-year-old former Fed Vice-Chair Alice Rivlin.

She received a lifetime achievement award last month and has one of the clearest, most-succinct attacks on the baffling collective blindness.

MarketWatch: Let's start with your views on inflation and the economy.

Rivlin: I don't think inflation is a threat for the foreseeable future. We used to think of inflation as the major thing that central banks had to guard against, but that was back when our economy was much more inflation-prone than I perceive it to be right now. Inflation happens when you have a roaring boom - wages are rising, labor markets are tight - and wages and prices get into a spiral. We're not in that situation right now at all. We have a slow-growth economy, slow growth in wages, considerable slack in the labor market. unemployment rates have come down but we still have very low labor force participation, and that is partly because our population is aging, but it isn't all because of that. Rates for prime-age men are unusually low- we don't know exactly why that is, but it indicates that there is slack in the labor market.

So I don't see inflation as something we need to worry about right now. And even if it happened, even if we had some kind of shock that sent prices up for some reason, the Fed has the tools to stop inflation. That's not very hard. And we're unlikely to get into a self-perpetuating spiral because the economy is much more competitive than it used to be and because we haven't had inflation for such a long time. There is a whole generation of people who don't remember inflation. They don't know what it is. And so I think inflation is a non-existent threat.

MarketWatch: But, even with inflation so low, 15 out of 17 Fed policy makers want to raise rates this year. What is going on?

Rivlin: I think there is a perception at the Fed, and probably pretty much shared by everybody, that it would be nice to get back to normal. And normal means that you have an interest rate which you can both raise and lower. And the Fed is not in that situation right now. They are very close to zero. And so it would more comfortable to be at a higher interest rate.

Here's the scariest thing.

Central banks are fighting an unwinnable battle. The only way they can create the illusion of inflation is by artificially driving down currencies and fuelling an insane credit bubble.

The truth about central banks is that they're a power structure. They can preach a brand of smelling-their-own-farts academic independence all day long but one thing is true about power: The aim and the always-corrupted purpose of power is to get more power; to hold onto power.

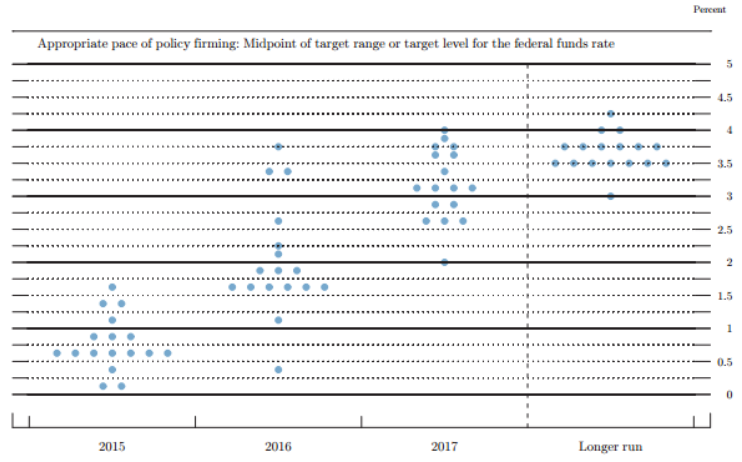

If policymakers accept they will never meaningfully hike rates then the Fed is an afterthought -- a glorified bank regulator. A power structure simply cannot do that because it would destroy its power. It's impossible to abandon the power of markets hanging on your every word. Fed officials are forced to delude themselves that things will 'go back to normal' by putting blue dots on a chart predicting a 3.75% longer-run Fed funds target.

The Fed dot-plot will go down as a monumental example of collective blindness.

What's the solution?

Accept that inflation isn't coming back, at least without a near-total structural economic overhaul. Central bank leaders need to look politicians in the eye and say "we've done all we can, it's your turn."

Politicians have cowered since the crisis. Aside from a few Eurozone periphery countries with a metaphorical German gun to their heads, no one has done anything except pretending the good times are coming back again and trying to get re-elected.

Cutting interest rates are a powerful tool but controlling an entire government is an order of magnitude more powerful. Where are the leaders?