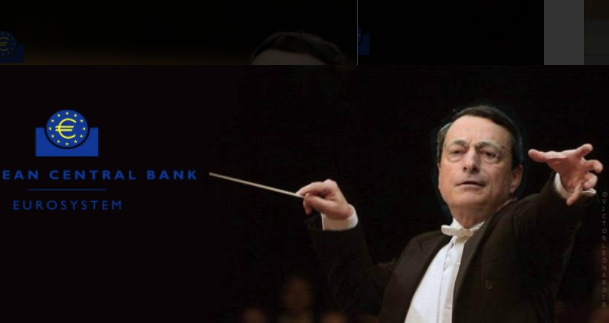

ECB president Mario Draghi's speech from Frankfurt, Germany

- Says sustained adjustment in the path of inflation towards target is the condition for net asset purchases to end

- Still need to see further evidence that inflation dynamics are moving in the right direction

- Now more confident than in the past that inflation is on the right track

- But risks and uncertainties still remain

- Net asset purchases remain necessary for now

- Even once outlook becomes less dependent on net asset purchases, monetary policy will still need to be patient, persistent, and prudent

- Key question is how quickly stronger demand will translate into rising prices

- Performance of underlying inflation remains subdued compared with previous recoveries

- Euro strength could weigh on inflation down the line

- Any policy adjustments to remain predictable, and will proceed at a measured pace

Nothing new but the key highlight seems to be the euro strength, but it's also not something new that hasn't been said before.

Either way, the euro is taking a slight dip with EUR/USD falling to session lows of 1.2376 now from 1.2390 earlier. Seems like it's more of a dollar related move, as cable also falls to a low of 1.3950 on the session.