- Main indicator hits 5.99 vs 4.56 prior

- BOC notes that survey was carried out before omicron hit

- 77% of firms see labor shortages intensifying

- More firms report impacts from labor shortages and supply chain disruptions, including continued drag on sales

- Most businesses set to increase investment and plan to raise wages to compete for workers

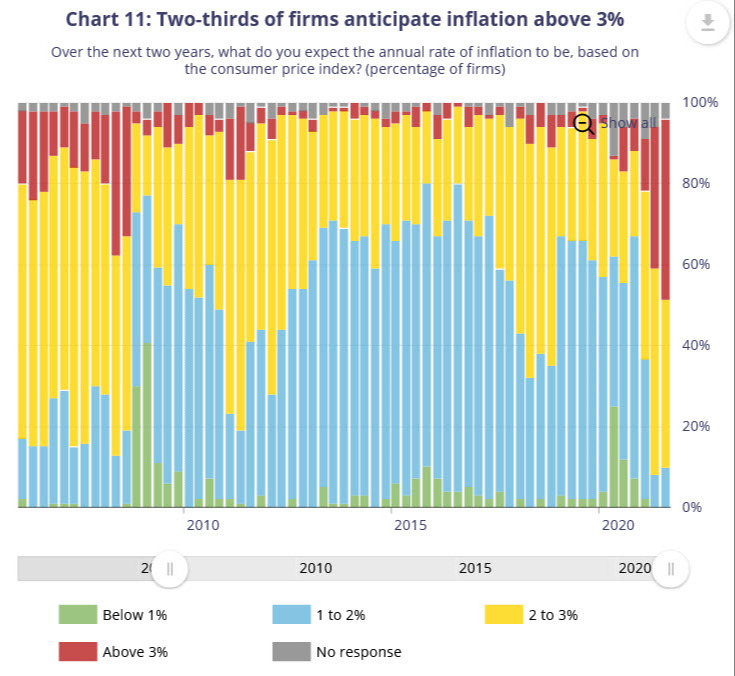

- Two thirds of businesses expect inflation to be above the BOC's 1-3% control range over the next two years

- Plans to invest 47% vs 46%

- Q4 BOC survey of consumer expectations sees inflation hits a survey high of 4.89% over the next 12 months

"The combination of strong demand and bottlenecks in supply is expected to put upward pressure on prices over the next year," the survey said.

The next Bank of Canada decision is January 26 and the market is pricing in a coin flip or whether or not they hold rates. The BOC takes this survey very seriously and it should push them closer towards tightening. That said, omicron closures in Canada have been significant -- including schools -- and that could also factor into the decisions.

I think they'll hike and the Canadian dollar is up about 10 pips on this report.

The signs of inflationary pressures, strong demand and capex are unambiguous.