A technical signpost to watch for

There are a lot of candlestick patterns. Some are more distinctive, some are less. It's easy to be on the lookout for pin bars - candlesticks with long upper or lower wicks that indicate a reversal.

However, such candlesticks, though quite common, do not appear all the time. Plus, there are other patterns worth paying attention to, for example, 'inside bars'. Monitoring inside bars is much less intuitive.

Yet, inside bars can be no less helpful and provide traders with trade ideas that have a big probability of success. In this article, we have gathered some useful tips about inside bars.

What is an inside bar?

As you can deduct from the name of this pattern, an inside bar is a 2-candlestick pattern, in which the second candlestick is completely engulfed by the first one. The first candlestick is called 'mother bar', while the second one bears the name of the pattern itself.

The color of the inside bar is not important. The difference between an inside bar and harami is that with an inside bar, the highs and lows are considered while the real body is ignored.

An inside bar forms after a large move in the market and represents a period of consolidation. It indicates that the market is seized by indecision: neither bulls nor bears can swing the price in their favor.

The idea is that after consolidation the price tends to make a strong directional move. As a result, if a trader spots a moment of calm (i.e. an inside bar), he/she will be able to trade on the breakout of the consolidation range.

If an inside bar formed within a strong trend, the odds are that the breakout will occur in the direction of this trend.

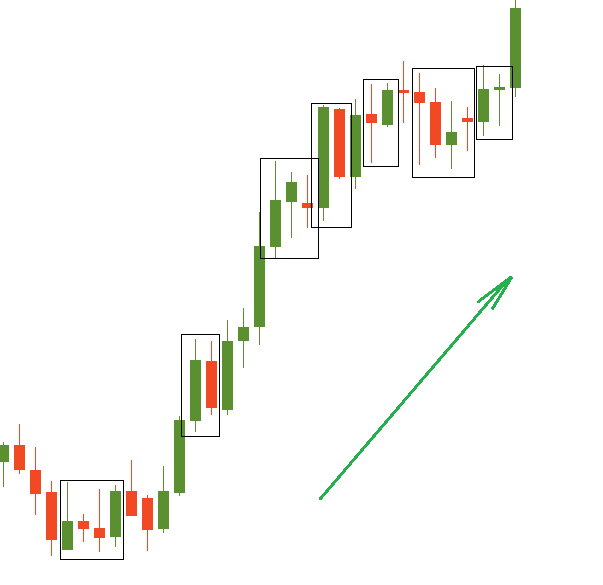

A string of inside bars during an uptrend

All in all, the smaller the inside bar relative to the mother bar, the greater the possibility of a profitable trade setup. Plus, the best case is when an inside bar forms within the upper or lower half of the mother bar.

All of this shows that the preceding trend is still strong and hence likely to continue, so an entry in its direction will pay off nicely. Stop loss orders are usually placed at the opposite end of the mother bar or around its middle if the mother bar is bigger than average.

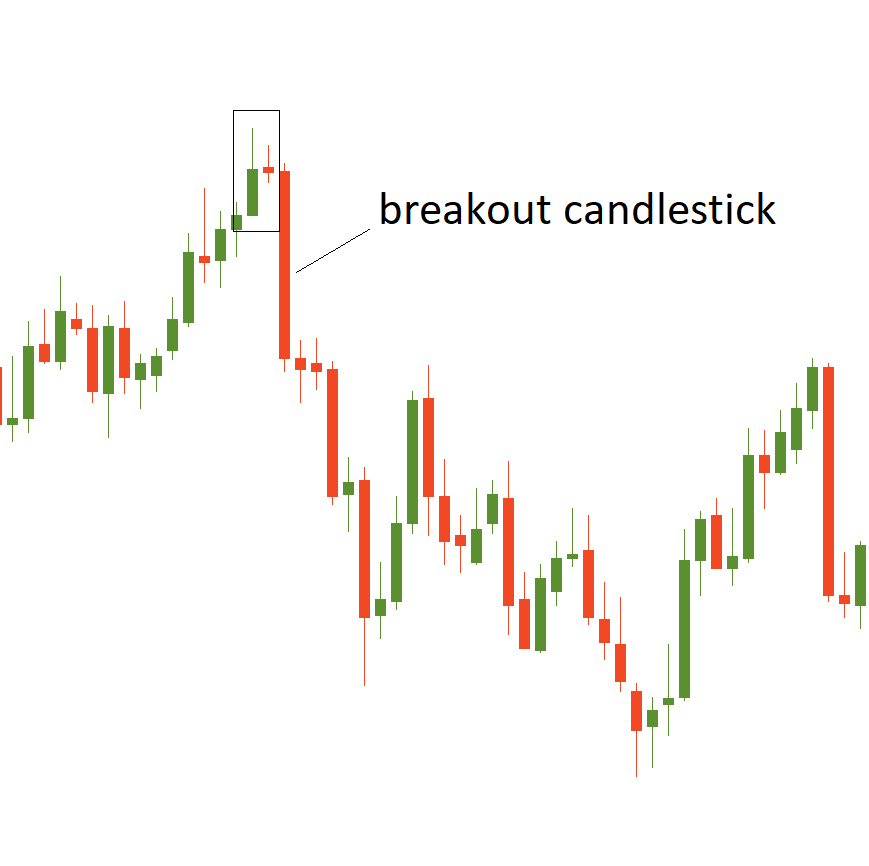

An inside bar followed by a strong breakout. Check the place where the inside bar formed: is there a strong resistance? This may explain why the price reversed down

Another tip: keep track of inside bars on the daily chart and bigger timeframes. Lower timeframes contain huge amounts of "noise" and thus may give false signals.

In addition, there may be several inside bars within the mother bar (i.e. 2, 3 or even 4). This simply means that consolidation will take longer, and the odds are that a resulting breakout will be stronger.

Inside bar and fakey

So, trading inside bars is all about breakouts. However, it's common knowledge that breakout may turn out to be false. A "fakey" pattern represents a false breakout of an inside bar.

In other words, it's when the price breaks out an inside bar but is unable to continue moving in that direction and quickly gets back. A fakey is a strong reversal signal.

Fakey may consist of one candlestick (in this case it will be a pin bar) or two candlesticks (the second candlestick will erase the progress of the first one). The most important characteristic is that a false break of the pin bar should be obvious and clearly visible at the chart.

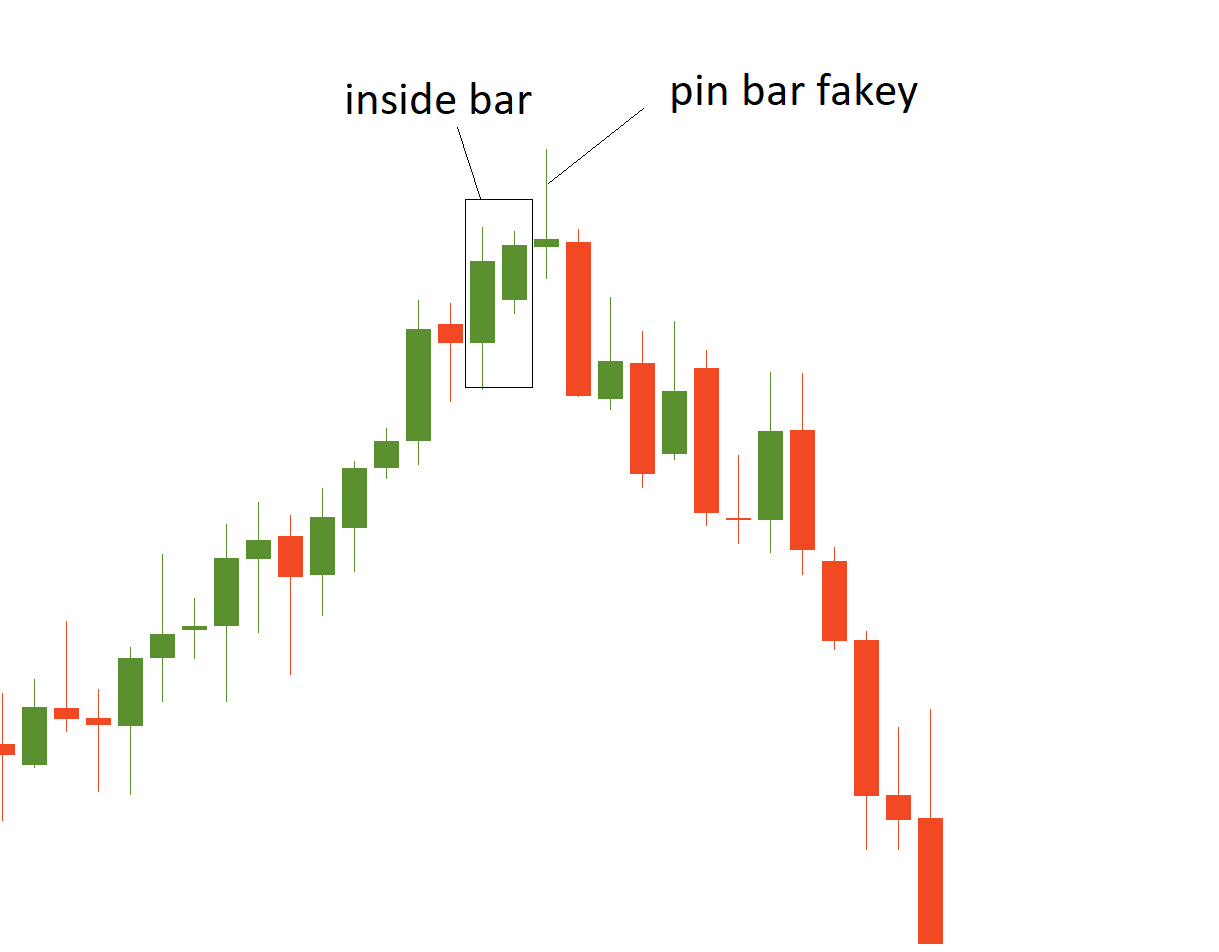

An example of a 2-candlestick fakey

An example of a pin bar fakey

It's wise to pick up a trade signal provided by a fakey if it forms near an important support/resistance level.

Conclusion

A thing to like about inside bar trading strategy is that it revolves entirely around the price action. Inside bar is not the most popular type of pattern but it can enhance your understanding of the market several-fold.

Don't forget to monitor trends and support/resistance levels to distinguish the continuation inside bars from potential reversal ones/fakeys. Finally, once a fakey is identified, it's a great hint of a new price swing and may be used as an entry cue as well.

This article was submitted by FBS.