A look into the more familiar patterns on the chart

This article was submitted by ICM.com.

Technical analysis is a type of analysis which is applied by traders on different financial assets, where they study the past price performance of a certain financial asset to forecast the future price direction or trend of this asset.

There are numerous ways of analyzing the markets via technical analysis. Some traders might use technical indicators and oscillators, while others prefer to use the price action itself.

According to the Dow Theory, the market discounts everything. In other words, the price of a certain financial asset discount all the past, current, and even future economic releases, events, etc.

So by studying the price action of a certain financial product, traders will be searching for repeated price patterns which could assist them in determining the future direction of the market.

In

this article, we will cover the classical chart patterns which are to split

into two categories: trend continuation patterns and trend reversal patterns.

Continuation Patterns

They are considered as a pause in the prevailing trend which implies that during an uptrend, the bulls are preparing for another push higher whereas during a downtrend, the bears are preparing for another push lower.

These patterns should be drawn properly by traders and they should be very patient while trading the breakout of such patterns to avoid being trapped in false breakouts. Usually, when these patterns take more time to form, they will be followed by significant price movements.

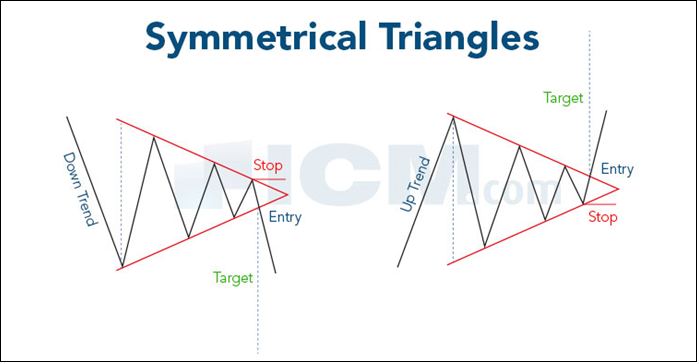

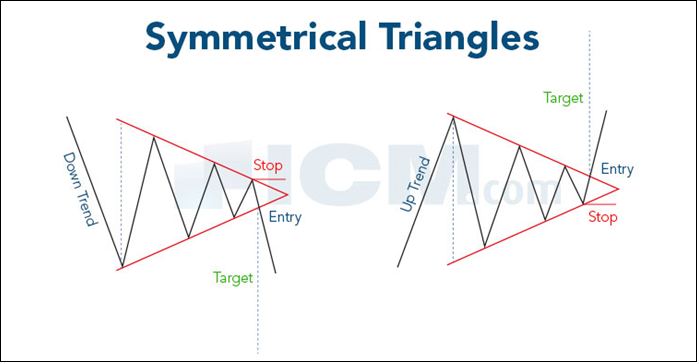

Triangles fall under the category of continuation patterns and are of three types: symmetrical, ascending, and descending.

A symmetrical triangle is formed of higher lows and lower highs which usually signals that the market is balanced and ready to move either way. As the triangle is being formed, the volume shrinks, and the breakout would be accompanied with great volume which leads the market to the next move.

An ascending triangle is usually considered as a bullish pattern which forms in an existing uptrend. It consists of a horizontal line combining the highs or resistance points, and a line combining a series of higher lows.

Despite the fact that the breakout could occur to either direction, traders usually await a break to the upside as the triangle is a continuation pattern which means that the market had a slight consolidation to prepare for an upcoming price move within the same direction of the prevailing trend.

A descending triangle is considered as a bearish structure which forms in an existing downtrend. It consists of a horizontal line combining the lows or support level and a line combining a series of lower highs. Traders will be waiting for a break to the downside as they believe that the market took a pause from the prevailing trend and the trend will resume when we breakout from this consolidation pattern.

Reversal Patterns

Reversal patterns are patterns that occur at the end of a prevailing trend to give a signal to the trader that there could be a possibility of a change in direction. In other words, these patterns will help us indicate that the current price movement has topped or bottomed.

If a trader was holding buy positions in an uptrend, and he detected the formation of a possible reversal pattern, then he should be thinking of liquidating his position and re-assess his bias. Among the most recognized classical reversal patterns are the head and shoulders formations, the double top & bottom, and the triple top & bottom.

Head and Shoulders patterns consist of three peaks with the middle peak being the highest, the left and right peaks holding similar or close price levels. The volume will be the largest in the first shoulder and starts to decrease until we break out from this formation.

A Head and Shoulders pattern will appear at the top of an uptrend, while an inverted head and shoulders pattern will form at the bottom of a downtrend.

Double/Triple tops and bottoms are among the most reliable reversal chart patterns and can be found easily on charts. Usually, they are formed when the price of a financial asset retests a resistance or support zone without being able to break above or below respectively.

Some traders add technical oscillators such as the Relative Strength Index and search for divergence to confirm their trading setup.

If we go over charts of different time frames or even range charts, we will be able to find a classical chart pattern, whether from the mentioned above or the rest. However, it is always better to adopt the formations that occur on higher time frames taking into consideration the length, uniformity, and clarity.

Traders should always be cautious about being stuck in a false breakout. In order to avoid such entries, a trader should make sure that the breakout is occurring with heavy volume, or ignore the initial breakout and wait for a retest to the neckline/support/resistance and jump into a trade. Chart patterns will help you pick your trades.

Many traders wait for such formations to trade which would lower their number of trades and also reduce the percentage of losing trades.

Despite the theory that price discounts everything, it is better to always apply fundamental analysis along with technical analysis. When a technical trading setup matches the fundamental analysis findings, the trade would have a higher chance of success.

Finally,

we advise all traders to stick to strict risk management techniques as risk

management is the key to successful trading.