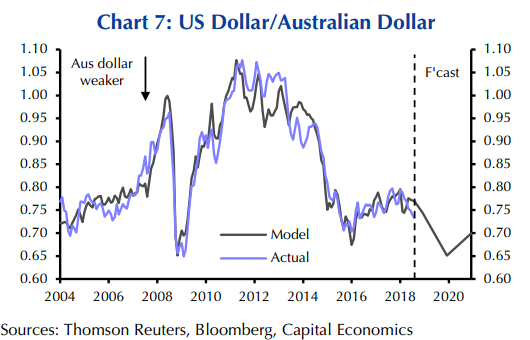

A forecast for the Australian dollar via Capital economics,

to 0.65 against the USD by the end of 2019

- A narrowing of interest rate differentials may prompt a modest rebound to about US$0.70 in 2020

Cap Eco citing (this in brief, bolding mine) on Australia :

- First rate hike from the RBA to come in late in 2020

- faster employment growth will support consumption .. (but) … the consequence of the surge in household debt to record highs will be a period of slower consumption growth

- over the past year we have become more worried about the outlook for the housing market, more concerned about the near-term consequences for the economy if the Labor Party were to win the election due by May 2019 and less bullish on the outlook for the global economy

- we expect GDP growth in Australia to slow

- we have been struck by how little wage growth and underlying consumer price inflation have risen

- surprised at how dovish the RBA has stayed

- In other words, we've become more convinced that the link between economic growth and inflation is much weaker than it used to be and more convinced that the RBA is not going to rush to raise interest rates

- iron ore price will fall

- investors will seek safe havens as US GDP growth slows next year

On the USD side of equation:

- we are expecting the US Fed to cut interest rates in 2020

- would … mean that the RBA misses the global tightening cycle

- That's not as unusual as it sounds either as Australia's business cycle has not been in sync with America's for the best part of 20 years.

- (so) the downward pressure on the Australian dollar may be a bit stronger than we previously thought