The Reserve Bank of Australia announcement and Statement (from Governor Lowe) are due at 0430 GMT on 3 April 2018

- There is no expectation of any change in the cash rate

- Attention will swing to the Statement.

Preview via Barclays:

- We expect no policy changes

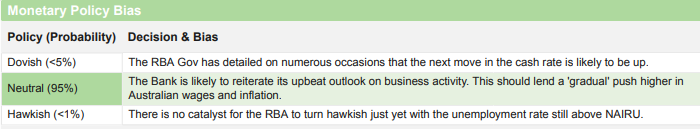

- The RBA is likely to hit a cautious tone on its policy outlook, given the recent trade war concerns and the correction in Australia's commodity basket.

And, via TD:

- We can't see how the RBA can inject hawkish tones into April's Statement compared with the one released earlier this month. Aside from monthly employment and NAB business conditions continuing to shine, which should see the Bank retain its focus on the 'gradual' improvement in inflation and unemployment, hard data outcomes - Jan retail sales, Q4 GDP - have disappointed. Also metal/bulk prices have generally softened, led by a near 20% decline in the iron ore price this month.

- Of more interest is the rise in the 3m BBSW rateset, yet bill futures do not believe the move will be sustained. Our work suggests that repo could remain elevated and this could keep the cost of unsecured funding elevated as well. Accordingly bill futures should ultimately correct lower in price. We will assess this post the Q1 turn.