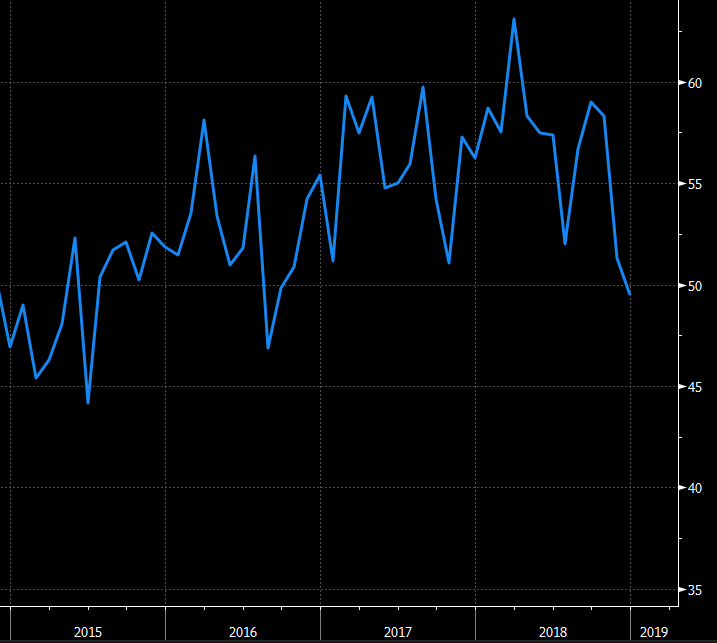

Australian Industry Group Performance of Manufacturing Index for December falls into contraction at 49.5

- November was 51.3

The fall in December (down 1.8 points) comes after a big fall in November (down 7 points).

The last time the PMI fell into contraction was mid-2016 (see graph above … the index is now at its lowest since August 2016).

More from AiG on the result for or December:

- Six of the seven activity indexes fell

- Food & beverage manufacturers and businesses in the smaller manufacturing sectors reported higher production in the lead up to Christmas

- while respondents across the large metals, machinery & equipment and chemicals sectors reported a gradual slowing of demand, which has been evident throughout the second half of 2018.

- Five of the eight sectors expanded in December

- two were broadly stable (machinery & equipment and chemicals )

- one was in contraction … large metals sector was the only sector to contract in December

- input price index rose again in December to a three-month high (high input costs for gas and electricity)

- average wage index rose in December

- selling prices index fell into contraction (means that businesses' margins were very tight in December, as wage and input costs continue to grow)

- Three of the seven activity indexes contracted in December, three were stable and only finished stocks was expansionary.

- Most of the activity indexes have been trending down since at least the start of Q4 2018

- Six of the seven activity indicators fell indicating generally weaker conditions

Not a positive input for the AUD.

---

This is the second of the Australian manufacturing PMIs for December, last we week we had the CBA / Markit version