The National Australia Bank Business Survey just out painted a more positive picture for jobs

Data here: Australia: Business confidence 5 (prior 12) & business conditions 15 (prior 15)

Earlier, NAB had a preview of Thursday's upcoming jobs report from Australia:

- Employment for August is the main data for Australian markets this week.

- NAB (and the consensus) looks for another solid report with a steady unemployment rate of 5.6% and around 20,000 new jobs created.

- This month's release also includes the latest quarterly reading on underemployment.

TD Securities is similarly sanguine:

- August is a weak month for jobs in original terms, followed by a very strong Sept. This reversed in 2014 and threw the seasonal adjustment process into chaos.

- Assuming no such twist for 2017, we look for a "normal" +10k in August (and +20k in Sept) boosting annual employment growth to a solid 2.2%/y, a pace consistent with buoyant job vacancy data.

And, via Westpac:

- Total employment rose 27.9k in Jul. The Australian labour market went through a soft patch in 2016, particularly from Aug to Nov but it saw a solid uplift as we moved through 2017. The annual pace accelerated from 0.9%yr in Feb to 2.0%yr in May where it held that pace through Jun and July. In the year to Feb total employment grew 106.8k; that has since lifted to 239.3k in the year to Jul.

- Full-time employment fell 20.3k in Jul following a 69.3k surge in Jun and a solid 53.9k gain in May. Over the year full-time employment gained 197.7k/2.4%yr. Part-time employment rose 48.2k following a 49.3k contraction in June and -14.3k in May. In the year to July, part-time rose 41.6k/1.1%yr.

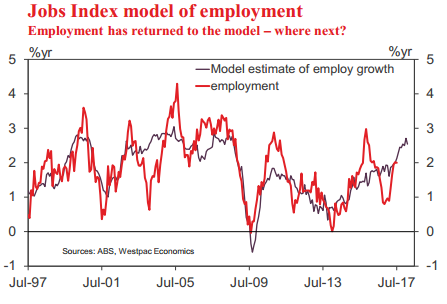

- The current momentum looks set to continue into 2018 with our Jobs Index pointing annual employment growth of around 23⁄4%yr by end 2017 to early 2018. As such we are looking for current momentum to hold with a 20k forecast for August lifting the annual pace to 2.3%yr.

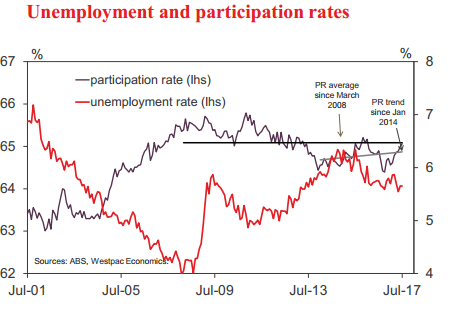

- In July, unemployment fell 0.1ppt to 5.6% (June was revised up to 5.7%) as the participation rate nudged up 0.1ppt to 65.1% driving a rise in the labour force. At two decimal places the unemployment rate was 5.65%.

- Participation has lifted since the Oct 2016 low of 64.8 and is getting back towards the recent high of 65.2% seen in Nov 2015. We expect the solid employment outcomes to continue to drag the participation rate higher over time but in Aug it will round down to 65.1%. This will see the unemployment rate to round up to 5.7%.

(bolding above is mine)