Monthly retail sales, for September comes in flat, at 0.0% m/m

- expected +0.4% m/m, prior -0.6%

Another miss for this sector. Comes after the terrible August result.

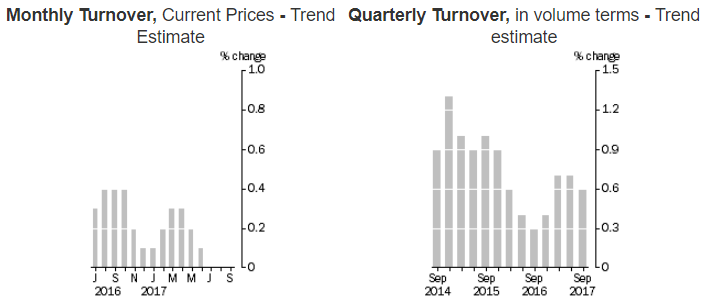

Check out the graph on the left ... that does not looks good at all for the past 2 months.

The Australian Bureau of Statistics with the major points (I was gunna say highlgihts, but ummm, no):

- trend estimate was relatively unchanged (0.0%) in September 2017 following a relatively unchanged estimate (0.0%) in August 2017 and a relatively unchanged estimate (0.0%) in July 2017

- The seasonally adjusted estimate was relatively unchanged (0.0%) in September 2017. This follows a fall of 0.5% in August 2017 and a fall of 0.3% in July 2017

- In trend terms, Australian turnover rose 2.0% in September 2017 compared with September 2016

- The following industries fell in trend terms in September 2017: Household goods retailing (-0.5%), Cafes, restaurants and takeaway food services (-0.1%) and Department stores (-0.1%). Food retailing rose (0.1%) and Other retailing (0.0%) and Clothing, footwear and personal accessory retailing (0.0%) were relatively unchanged in trend terms in September 2017

- The following states and territories fell in trend terms in September 2017: Victoria (-0.1%), Western Australia (-0.3%), South Australia (-0.1%), the Australian Capital Territory (-0.2%), the Northern Territory (-0.2%), and Tasmania (-0.1%). New South Wales rose (0.1%) and Queensland (0.0%) was relatively unchanged in trend terms.

The annual growth noted is the slowest since June of 2013.

I'm awaiting responses from analysts ... let me pre-empt:

- high household debt

- high energy bills

- slow wage growth

all weighing on consumers.

more to come

AUD back under 0.7700

--

Out at the same time, the Q3 data for retail sales excluding inflation, 0.1% q/q

- expected 0.0%, prior +1.5%

Retail volumes are hanging in there ... fierce price cutting though is weighing on results.