Commitment of traders report for the week ending September 18, 2018

- EUR long 2K vs 11K long last week. Longs trimmed by 9K

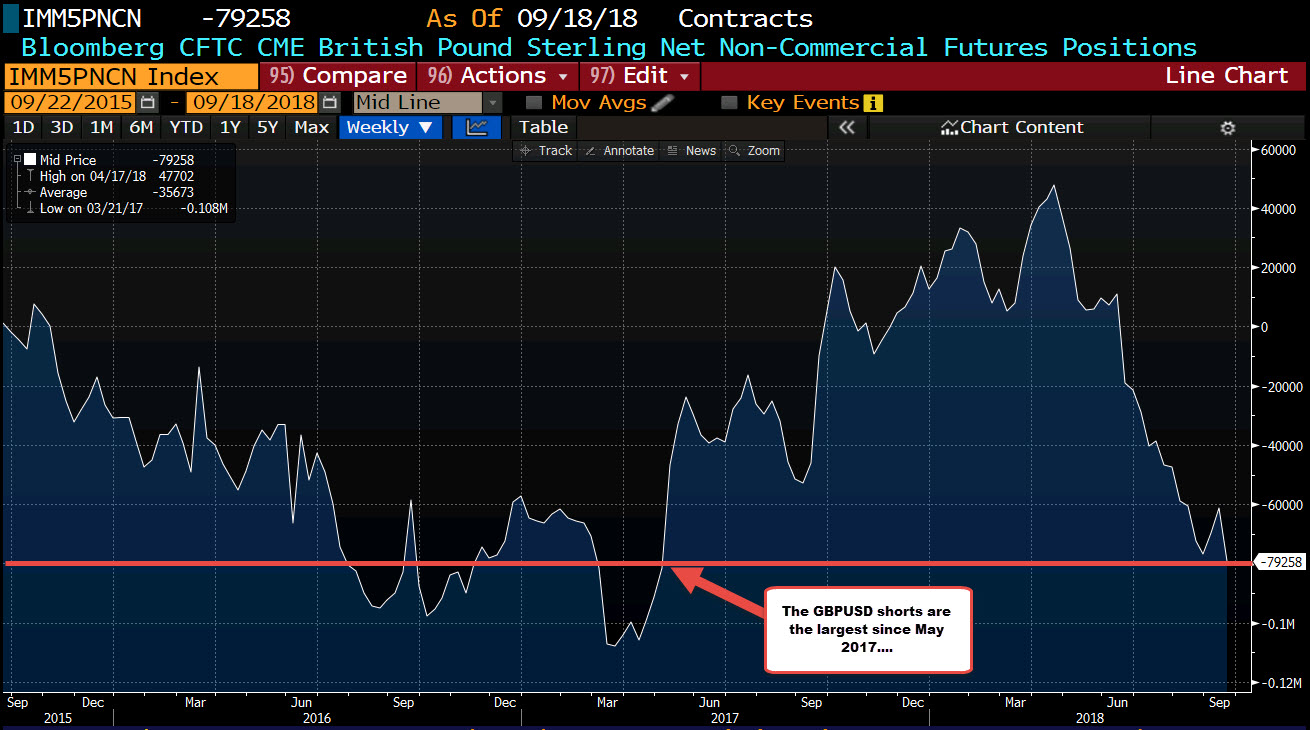

- GBP short 79K vs 61K short last week. Shorts increased by 18K

- JPY short 64K vs 54K short last week. Shorts increased 10K

- CHF short 18K vs 35K short last week. Shorts trimmed 17K

- CAD short 30K vs 27K short last week. Shorts increased 3K

- AUD short 68k vs 44k short last week. Shorts increased by 24K

- NZD short 32K vs 23K short last week. Shorts increased by 9K

- Prior week.

Highlights:

- EUR position moves toward square from long.

- AUD shorts increased by a healthy 24K. The short is the largest since March 2015. The AUDUSD is trading near the week's highs running counter to the short position

- CHF shorts continued to be trimmed. Since August 21 when the shorts bottomed at -47K. They are now at -18K.

- GBP shorts also increased by a decent amount as traders gear up for Brexit issues. Today those short are looking better than earlier in the week. The short position is at the largest since May 2017.