Latest data released by Markit - 23 July 2021

- Prior 58.3

- Manufacturing PMI 62.6 vs 62.5 expected

- Prior 63.4

- Composite PMI 60.6 vs 60.0 expected

- Prior 59.5

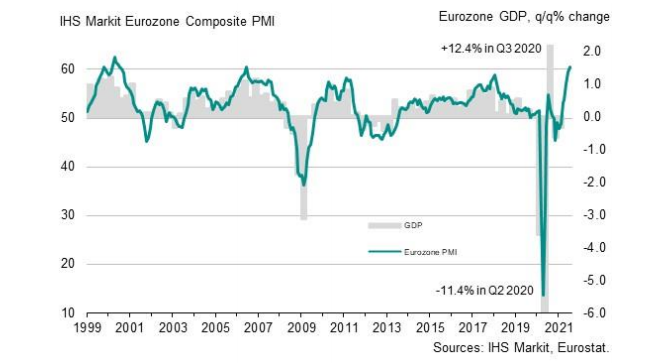

A solid bump in business activity with the strongest rise in over 15 years observed in the services sector. Supply chain disruptions dampened manufacturing output but overall conditions are still relatively robust to start Q3.

Prices for goods and services continue to run at a record pace, reaffirming higher cost inflation pressures. Meanwhile, backlog of work rose at a joint-survey record amid capacity constraints. Markit notes that:

"The eurozone is enjoying a summer growth spurt as the loosening of virus-fighting restrictions in July has propelled growth to the fastest for 21 years. The services sector in particular is enjoying the freedom of loosened COVID-19 containment measures and improved vaccination rates, especially in relation to hospitality, travel and tourism.

"Supply chain delays remain a major concern for manufacturing, however, constraining production and pushing firms' costs higher. These higher costs have led to a near record increase in average selling prices for goods and services, which is likely to feed through to higher consumer prices in coming months.

"The survey also highlights how the delta variant poses a major risk to the outlook. Not only have rising case numbers led to a slide in business optimism to the lowest since February, further covid waves around the world could lead to further global supply chain delays and hence ever higher prices."