That is assuming US data continues to run hot in the months ahead

However, given how things are looking so far, there is little reason not to expect such conditions to continue - though there will be some interesting caveats.

Take the US CPI report this week for example, while supply constraints are one issue, there's also this irregularity as Adam pointed out at the time:

One big driver of the surprise was a 10.0% m/m rise in used car and truck prices, which is the largest in series history and single-handedly accounted for one-third of the rise. That made it a shockingly bad month to buy a car and is undoubtedly related to shortages.It wasn't just that though as shelter rose 0.4%, transportation rose 2.9% (big jump in airfares at +10.2%), automotive insurance (2.5%), household furnishings (+0.9%) and apparel (0.3%) were factors.Another factor for cars was the return of car rental companies. Normally they buy new cars but because of chip shortages, they haven't been able to find them. So they went out into the used markets and were price insensitive. Of course, big stimulus checks also arrived in March/April.

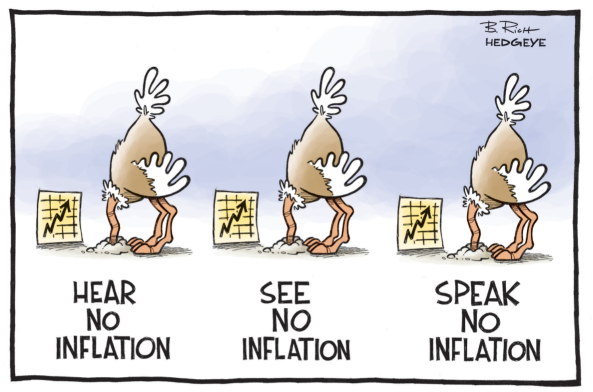

In general, economic data these days are clouded by a lot of complications at best and at worst, they practically don't tell us much of underlying conditions in actuality.

That said, the market will believe what it wants to and it is tough to deny that argument as it is as old as time. The question now is, how much of that can the Fed tolerate?

With every passing data point that continues to suggest that the US economy is set for a strong rebound in 2H 2021 and price pressures are going to persistently keep higher, it slowly chips away at the Fed's defenses surely.

While Powell & co. still wields the sword at the end of the day, the central bank has a knack for being bullied by the market over the years and we all know it.

So far, there hasn't been an outsized reaction to the inflation numbers this week by the Fed - rightfully so - but if we fast forward to July/August and we are in a similar spot, surely the kind of resolve we are seeing now may not hold too strongly.

Only time will tell. But barring any major pushback by the Fed to stick with looking through these developments, the market will slowly double down on the latest inflation bets.