A preview of Fed Chair Powell to speak on August 24 at the Jackson Hole symposium

- The symposium focus is "Changing Market Structure and Implications for Monetary Policy"

- Powell's speech title is: "Monetary Policy in a Changing Economy."

Barclays on what they are looking for

- We would look for guidance on how the Fed is incorporating the emerging contagion into its reaction function and also on whether the Fed has updated its views on the steady state level of reserve balances.

Barclays with the backdrop of Powell's speech:

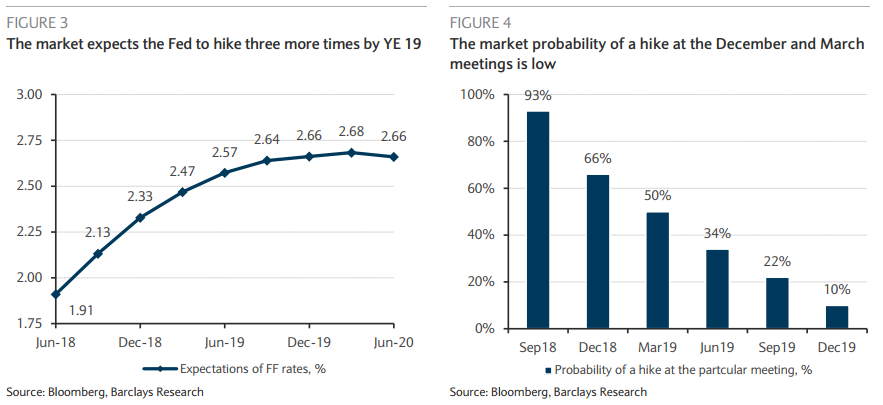

- The market is pricing in the Fed to hike three more time by the end of 2019, with the funds rate rising to ~2.7%

- We believe the Fed is likely to hike at a faster pace, absent a material adverse shock.

- while the market is pricing in a 90-95% probability of a hike at the September meeting, it is pricing in only 66% and 50% probabilities at the December and March meetings, respectively. As a result, we believe the front end is likely to remain under pressure. Further out the curve, we believe subdued term premium and demographic factors will keep a lid on long-term yields.