Forex news for Asia-Pacific trading Dec 18, 2015:

- BOJ to create new program to buy 300B more ETFs in three-part easing surprise

- Full text of the BOJ decision

- BOJ program not as big as it first seemed

- MNI China business sentiment 52.7 vs 49.9 prior

- China Nov new home prices +0.9% y/y

- ANZ New Zealand December business 23.0 vs prior 14.6

- UK PM Cameron: There is a pathway to EU agreement

- German finance ministry sees 'moderate' upturn in economy continuing

- Carney open to staying full 8-year term at Bank of England - FT

- Junk bonds hit by the third-highest net withdrawal on record

- China Beige Book: "Pervasive weakness" in the economy

- USD/CNY midpoint raised for tenth consecutive day

- Nikkei down 1.6% to 19,038

- Japan 10-year yields down 2 bps to 0.281%

- Shanghai Comp +0.2%

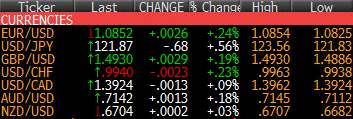

- JPY leads, USD lags

In the broadest sense, there as a theme of light US dollar weakness throughout the market. USD is 15-25 pips weaker across the board but that's a marginal move compared to the big post-Fed USD gains. Still, it bears watching as the day progresses, especially with equity markets souring.

The big story was the BOJ. Here's how it went down. The meeting started to run late so a little bit of USD/JPY buying crept in on punts on the outside chance that the BOJ eased. Then the first headlines crossed saying there was no change and USD/JPY feel a handful of pips. Then a second set of headlines followed about 15 seconds later indicating the BOJ was introducing a new ETF buying program.

The details of the ETF program were absent at first and USD/JPY shot more than cent higher to 123.50. Headlines about a maturity extension and JREIT buying hit too. Then the details started to come out. The ETF buying was only 300B yen more and it's to replaced a 2002 program that was selling Japanese stocks. The JREIT program was only 90B. So you only really have 0.39T in new annual buying compared to 83.00T already announced.

That took awhile to really sink in but USD/JPY fell to 122.40, chopped a bit and then started a slow slide lower down to 121.89. Here is a bit more on why there has been so much disappointment, despite some unexpected fresh easing.