Forex news for Asia trading Friday 19 August 2016

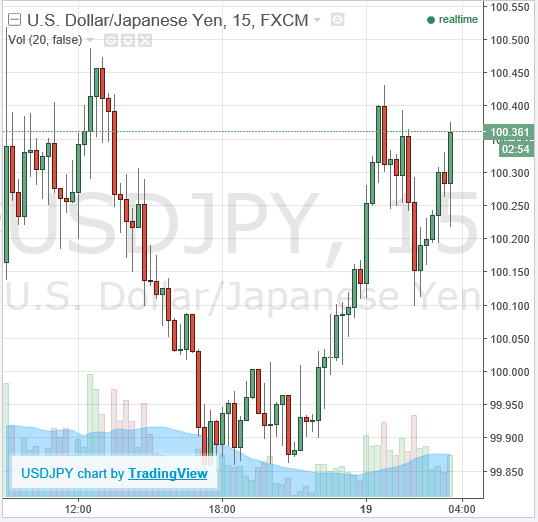

USD/JPY dropped to the 99 big figure again, but managed to bounce back, again:

- Morgan Stanley expects more yuan weakness in H2 2016

- PBOC sets USD/CNY central rate at 6.6211 (vs. yesterday at 6.6273)

- Fed's Kaplan: Expects firmer 2017 energy prices due to less supply

- China’s secret lists of zombie borrowers

- Australia press: Debt could blow out by more than $100 billion if ...

- Japan - Reuters Tankan Manufacturers index at +1 in August (+3 in July)

- Australia - ANZ take note of a "strong recovery in capex in the non-mining states"

- Another look at the Aussie employment data

- New Zealand - Net migration (July): 5600 (vs. prior 5670)

- Trade ideas thread - TGIF edition

- German Finance Ministry - domestic economy in solid shape, external risks

- Still more from Fed's Williams: September rate hike should definitely be in play

- Recap of Fed's Williams comments today

- More from Fed's Williams: Wage growth has finally started to pick up

- Help me out here - Fed's Williams and his Green Day reference

- Fed's Williams: Calls for rate hikes sooner rather than later

And plenty of action in the yuan today, with CNH dropping (against the USD). The USD/CNH strength seemed to weigh on currencies nearly across the board.

Earlier on in the Asian morning, though USD/JPY gained solidly, up 50+ points from its lows before topping out around 100.40. As just noted, it fell back after the yuan opening. Bigger downdrafts against the USD were seen elsewhere, though.

AUD/USD traded on the soft side for nearly the whole session, as did the NZD/USD. There was little in the way of fresh news, but missed employment data from Thursday and less than positive overnight developments continued to weigh.

Moody's revises outlook for 5 Australian banks to Negative

Australia press: Debt could blow out by more than $100 billion if ...

AUD/USD is nearly on it session lows as I post having lost 60+ points from early highs here today.

EUR/USD and cable are also weaker, and USD/CHF higher. Movements in these have been smaller (nevertheless cable is off 50 odd points from its session high)but all moving along with the stronger USD today.

A very quiet session for data, the Reuters Tankan indicating more weakness in the Japanese economy (the manufacturers index hit its lowest level since April 2013), coming after the very poor import and export trade balance data yesterday. We also got remarks from two regional Federal Reserve Bank presidents, Robert Kaplan of Dallas and John Williams of San Francisco (see bullets above).

Regional equities:

- Nikkei +0.35%

- Shanghai -0.45%

- HK -0.29%

- ASX +0.30%

FX updates: