Forex news for the European morning trading session 17 Nov 2017

News:

- UK's Davis says many EU countries want to move on to post-Brexit trade talks

- ECB's Draghi says Eurozone in midst of solid economic expansion

- Pound retreats as sellers prevail

- Latest poll sees UK economy lagging peers over next 2 years

- Mugabe makes first public appearance since house arrest

- PBOC says highly indebted firms will not be allowed to invest in asset management products

- Japanese PM Abe pledges to beat deflation 'once and for all'

- Forex option contract expiries for today 17 Nov

- AUD under the cosh still as AUDJPY dominates the landscape

- Pound looking perky but sellers still poised

- AUD/USD moving to a fresh session low

- Trading ideas for the European session

- Nikkei 225 closes up +0.2% at 22,396.90

- ForexLive Asia FX news wrap: USD lower (AUD lags)

Data:

- Eurozone Sept current account EUR 37.8bln vs 34.5bln prev

- Eurozone Sept construction output mm 0.1% vs -0.25 prev

A lively morning that's seen an up n down journey for the pound, on-going yen demand and further AUD and NZD losses.

It's been a real mixed bag of reason with yen demand, option expiry interest, Brexit fragility and good ol' fashioned natural order interest all playing out.

GBPUSD had triggered stops through 1.3210 in Asia and headed up further early on to test 1.3250 only to retreat back round 1.3230. Another attempt followed then another a little higher at 1.3260 but decent sell interest that I highlighted along with EURGBP demand around 0.8900 ,plus some natural GBPJPY sell interest all combined to send pound longs scuttling and we've seen a test of 1.3180 support/demand, 0.8940 and 148.60 in the GBP retreat.

GBPUSD

That yen demand has put a lid on USDJPY rallies at 112.65 and an AUDJPY option expiry at 85.50 lent supply to core pairs, helping to drive AUDUSD down to 0.7542 from 0.7610. NZDUSD has also continued its retreat from 0.6880 to post 0.6780.

EURUSD meanwhile has been caught in the cross play crossfire finding support into 1.1780 and offers above 1.1800 with a few option expiries helping to contain too.

USDCHF and EURCHF both saw dips again but overall remain underpinned with SNB never too far away it seems.

USDCAD headed up from 1.2720 to 1.2765 largely on CADJPY supply and thus shrugging off oil gains.

- Equities started on the back foot but have recovered losses to post gains

- Gold has been underpinned at $1281 but failed above $1285

- Oil has been on a steady incline

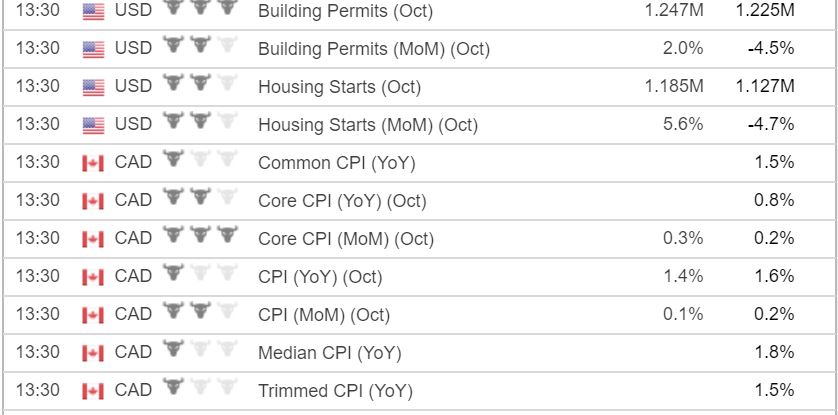

Not a lot of data of note today but here's what's coming up.