Forex news for the European morning trading session 12 Oct 2017

Featured article: Trading with Moving Averages

News:

- EU's Barnier says latest Brexit talks were constructive but no big steps forward

- UK's Davis says much work still needs to be done in Brexit talks

- More from Barnier: "No deal would be a very bad deal"

- ECB's Vasiliauskas says normalisation is a challenging process

- BOE survey sees lenders anticipating sharp decline in consumer credit availability

- Forex option contract expiries for today 12 Oct

- IEA leaves 2017 global oil demand growth at 1.6m bpd

- Citi ask: Is this the start of a long-term USD bear market Cycle? Where to target?

- Trading ideas for the European session

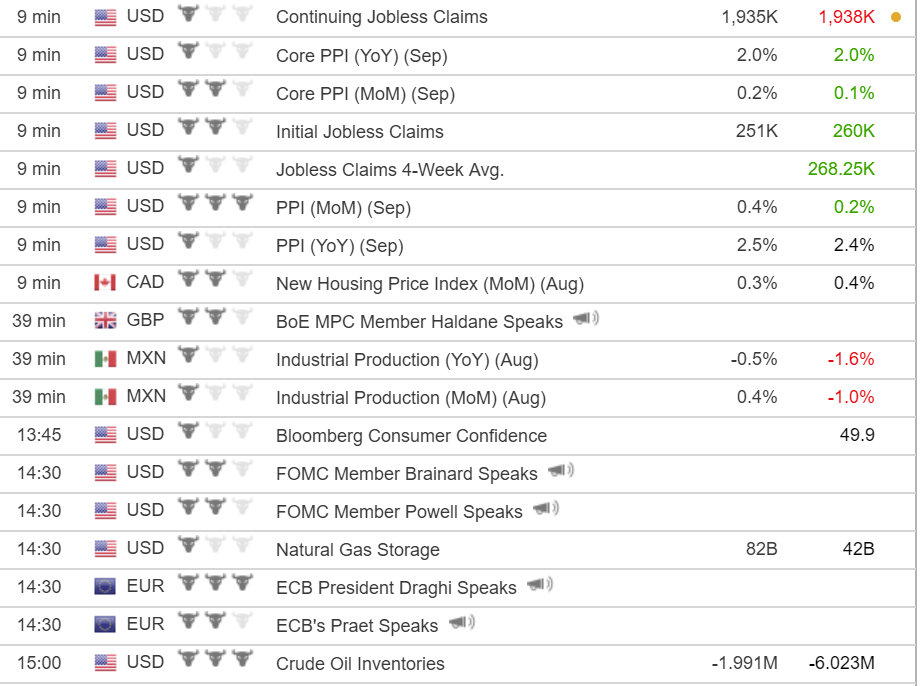

Data:

- France Sept CPI mm final -0.2% vs -0.1% exp

- Eurozone Aug industrial production mm SA 1.4% vs 0.6% exp

- China Sept vehicle sales yy 5.7% vs 5.3% prev

- Japan Aug tertiary industry index mm -0.2% vs 0.1% exp

A session that started slowly as markets digested the FOMC Minutes has developed at pace with USD demand returning and the pound getting slapped on Brexit talks impasse.

Here's the p/a summary;

- GBPUSD down to 1.3150 from 1.3255

- EURGBP up to 0.8923 from 0.8965 both on Brexit concerns

- EURUSD steady around 1.1860 but failing to breach 1.1880

- USDJPY finding support around 112.20 again after failing above 112.50

- USDCHF up to 0.9753 from 0.9720

- EURCHF up to 1.1560 from 1.1530

- USDCAD up to 1.2482 from 1.2440

- AUDUSD broke res at 0.7830 only to retreat back to support noted at 0.7810

- Oil

- Gold

NA data includes US weekly jobless at 12.30 GMT with BOE's Haldane , ECB's Draghi/Praet and Fed's Brainard/Powell all up to the mic