Forex news for US trading on January 25, 2016:

- ECB's Draghi: Economic outlook for 2016 is uncertain

- Decision on added BOJ stimulus may be a close call

- Some OPEC members seeking emergency meeting in March - Ecuador oil minister

- BOE Forbes: Need to see stronger labor cost before hiking rates

- Average daily FX volumes fall 21% y/y - BOE FX report

- Rebalancing could help stocks into month end

- ECB only buy €382m in ABS in latest weekly ECB QE count

- Average daily FX volumes fall 21% y/y - BOE FX report

- Gold up $11 to $1108

- WTI crude oil down $2.42 to $29.77

- S&P 500 down 30 points to 1877

- US 10-year yields down 4 bps to 2.01%

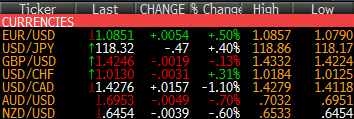

- Euro leads, CAD lags

Newsflow was light because of a quiet schedule and a winter storm cleanup in New York/Washington.

Traders settled in for a quiet day and it looked like that was coming as markets took a mildly negative tone. It improved on the BOJ cut chatter but the theme was mostly muddling along until oil rolled over through $31.

It continued down to $28.74 from there and finished at the lows. Risk trades went down with it, especially after a downgrade to oilfield services company Weatherford International.

Aside from CAD, the FX market largely ignored the first downtick in oil but as selling mounted and oil eventually dropped 7.6%, yen crosses began to wilt, especially NZD/JPY.

USD/JPY managed to hold the early European low of 118.17 but slipped from 118.50.

The euro price action underscored its role as a carry funder. As risk aversion mounted, it collected a bid and climbed through 1.0850 to 1.0857 in a series of higher highs.