US Q1 GDP is due at 1230 GMT on Friday 26 April 2019

Expected at 2.3 (annualised) q/q, prior 2.2%

Preview (in brief) via Scotiabank:

How soft was the soft patch? By historical standards, it might not have been terribly soft after all.

Scotiabank Economics estimates that Q1 GDP growth was probably at about 2% and possibly stronger.

- 'nowcast' model run by Scotia '... estimate of 2.4%

- Atlanta Fed's 'nowcast' is at 2.8

- … but nowcasts that are based upon longer-run models don't fully account for the effects of the US government shutdown

Shutdown influences would knock 0.4% off Q1 according to the CBO's estimate

- CBO estimates that ending the shutdown could add 1% to GDP growth in Q2

Preview (in brief) via Westpac:

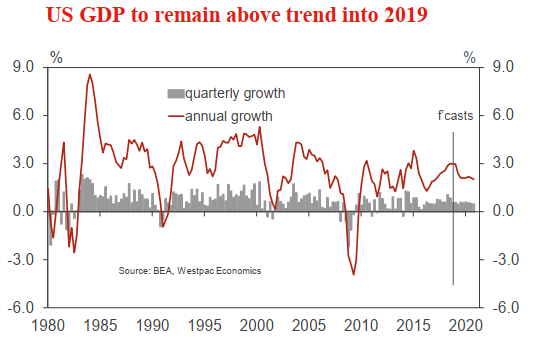

- US data at the turn of the year was disappointingly weak. However, as Q1 has rolled on, momentum has stabilised, and in some instances, begun to firm. As a result, we look for a gain in Q1 a touch above potential at 2.2% annualised

Graph via Westpac:

Barclays:

- We expect the GDP data to underline steady economic recovery. Differences in economic fundamentals is a key driver for currencies now that the Fed - and more recently the Swedish and Japanese central banks - have adopted a dovish stance

The US dollar is heading towards the data close to a two-year high. A disappointing GDP leaves room for some dollar give back. Steady or a beat … higher again for USD to come I reckon.