Gundlach is the founder of DoubleLine Capital, some remarks (via Twitter):

- "One of the reasons I think the dollar has stayed strong this year has been the yield starvation that exists in the world."

- "Investors have been forced out of need and yield starvation to buy U.S. assets naked; meaning, they're taking the dollar risk. And in spite of all that money coming into the U.S. dollar and not being hedged, the dollar has barely budged this year. "

- "To me, that reinforces my forecast that the dollar's next big move will be to the downside."

And:

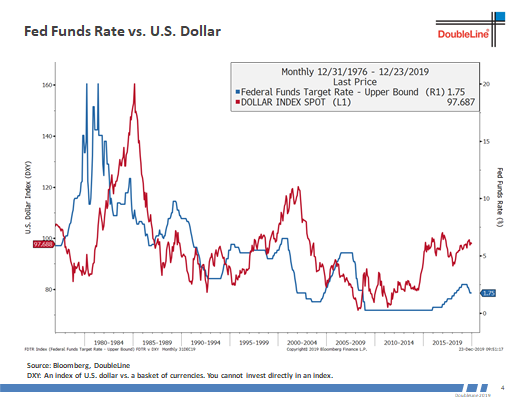

- "Dollar cycles, as I've said repeatedly in the past, tend to go on for multiple years and be quite persistent. And they are highly correlated with the fed funds rate, particularly the fed funds rate versus what is going on in other central banks."