Canada January GDP data is due on Tuesday at 1230 GMT (8:30 am ET).

After rising a healthy 2.1% in Q4, Canadian GDP is about to hit a rough patch. The drop in oil prices is about to hit the economy with full force.

The consensus estimate (and the Bank of Canada official estimate) for first quarter growth is 1.5% but signs are pointing to something much lower. Canada is one of the few countries to report on GDP each month and it's only January but the consensus estimate for Tuesday's report is -0.2%.

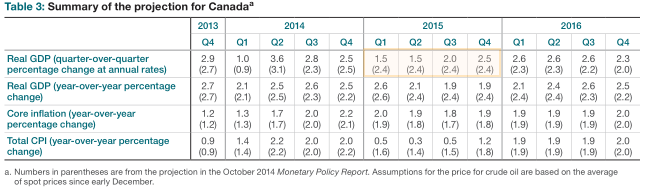

January BOC forecasts

For starters, on Friday, Bank of Canada Governor Stephen Poloz said growth looks slower than the bank's 1.5% estimate. A day earlier, deputy governor Timothy Lane said first half growth might be 'well below' 2%.

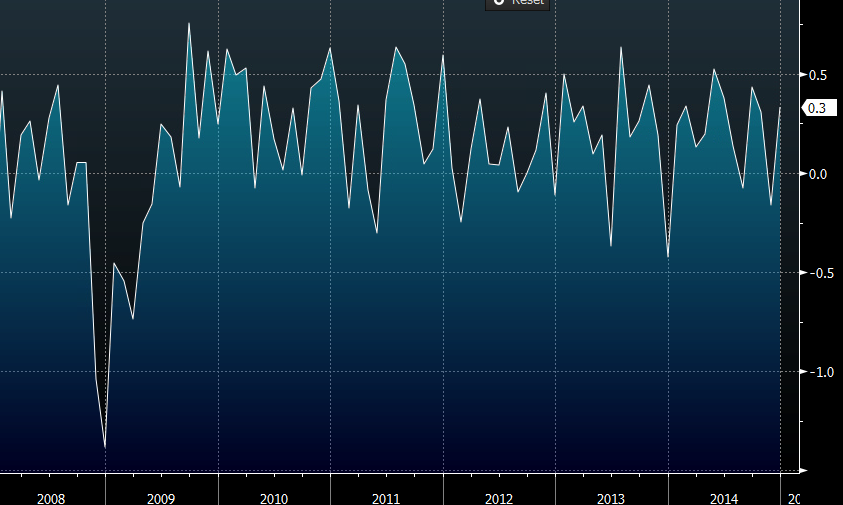

It might not be a coincidence that both BOC speakers late last week were warning on GDP ahead of the report. Estimates range from -0.1% to -0.5%. that sounds like a narrow range but remember that these are month-over-month changes so any miss is a relatively large one. A -0.5% drop in an economy in a single month an annualized 6% contraction and would be the worst since 2009.

Canadian GDP m/m change

How to trade the Canadian GDP report:

You can't separate the Canadian dollar from the oil trade. Tuesday is also the self-imposed deadline for Iran nuclear talks with signs pointing to a better-than-50% chance of a deal.

If negotiators find a compromise, oil prices are likely to suffer and boost USD/CAD and vice versa. For the most part, that may render the GDP report as a sideshow.

Here's a look at the 4 scenarios:

1) Iran deal + soft GDP report

That's the best possible scenario for USD/CAD longs and is the kind of thing that would bust the March high of 1.2835 and send the pair on a collision course with 1.30.

2) Iran deal + better-than-expected GDP

The market won't believe a strong GDP report so look to immediately buy any USD/CAD weakness. I suspect the bottom will be in minutes.

3) Iran deal falls apart + soft GDP

Get out of the way. Oil will rally and that could mean a squeeze lower in USD/CAD but with a soft GDP report, it would whipsaw. Dangerous trade.

4) Iran deal falls apart + strong GDP

This is a squeeze trade and it argues for selling USD/CAD. There will be money to be made but I think shorts should be quick to take profits.