Details of the September 2016 Canadian CPI data report 21 October 2016

Prior 1.1%

- 0.1% 0.2% exp m/m. Prior -0.2%

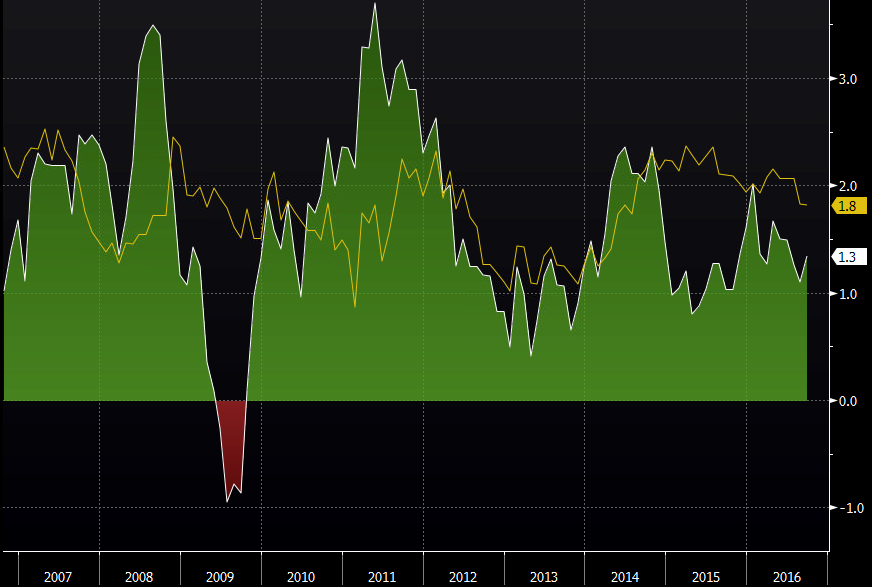

- BOC core 1.8% vs 1.8% exp y/y. Prior 1.8%

- 0.2% vs 0.2% exp m/m. Prior 0.0%

The BOC told the tale that they expected a weaker slant to inflation in their latest forecasts. The headline is a miss on expectations but still a gain on last month, and the core is holding up.

Canadian CPI & core y/y

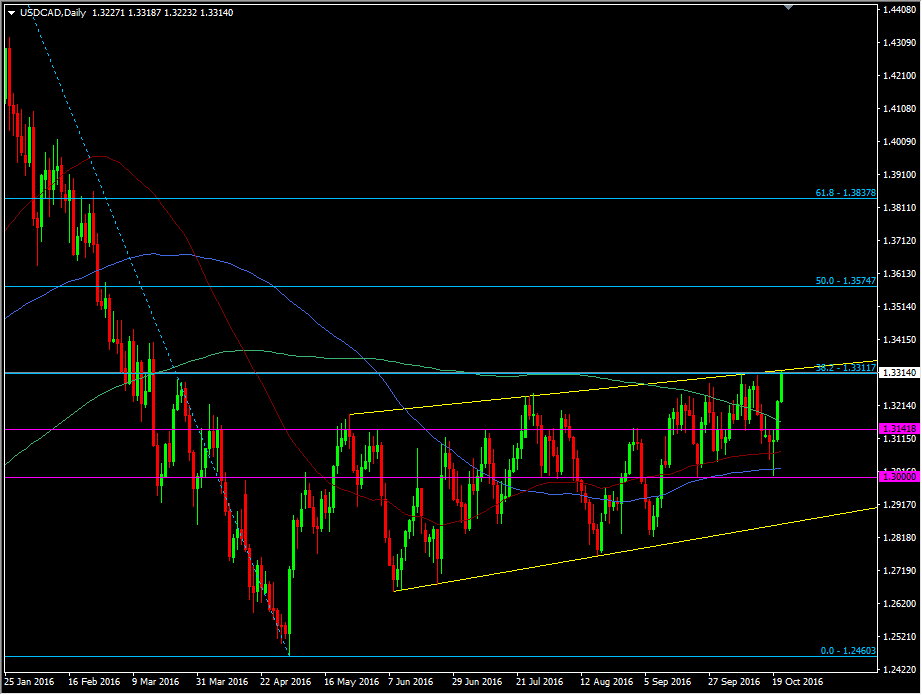

USDCAD has shot up to tickle 1.3300 and I've taken a small short on that test. The retail numbers aren't looking that rosey but they should be having a massive effect on the CAD. If the CAD is falling on these inflation numbers because the market thinks a cut is coming, I think they are way off line.

We'll see though and I'll keep a tight stop in above the 38.2 fib of the year's hi/lo and top of the uptrend.

USDCAD daily chart