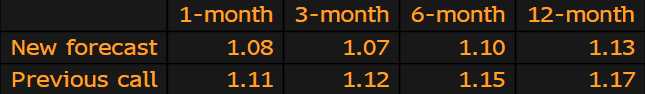

ING lowers their forecasts for the euro

The firm argues that the euro will weaken to levels last seen in 2017 against the dollar due to threats stemming from US trade policy. Noting that:

"Further deterioration in the US-China trade war will drive the euro lower. But there is also a non-negligible risk of the US imposing, or at least threatening to impose auto tariffs on Eurozone exports. An overhang of such tariffs should weigh on the euro."

Expanding further, the firm also views that the market already has "very aggressive" expectations of the Fed easing and that makes it hard for the US central bank to surprise and precipitate dollar weakness against the euro.

Adding that the dollar still enjoys high carry and that makes its positioning for a decline - in terms of yields - as "unattractive".

Also, they no longer see EUR/USD as being undervalued so that won't provide a supportive factor to the pair and notes that short positions are not stretched:

"This means that EUR shorts can still be built and positioning does not act as a limiting factor behind the EUR/USD fall."