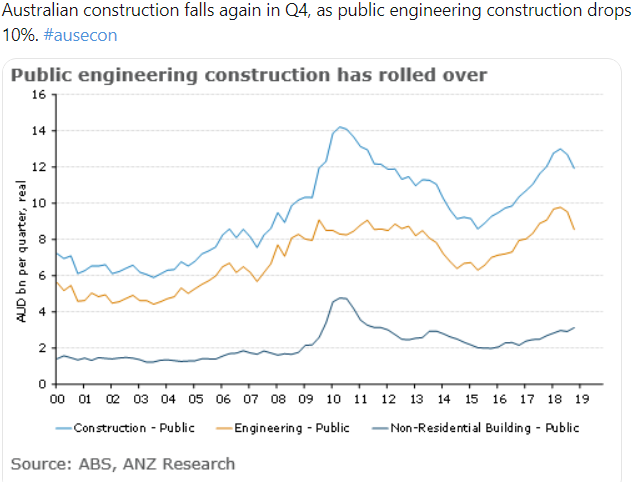

Construction data from Australia slumed for a big, big miss in Q4 2018

Earlier posts:

- Another response to weak Australian construction data: downside risk to Q4 GDP

- Australia data - construction work done -3.1% q/q (vs. expected +0.5%)

- AUD response to the dreadful construction centre data ... subdued

- Response to weak Australian construction data coming in - RBA to cut twice in 2019

Rounding up another few takes on the data, in brief:

ANZ:

- the weak H2 2018 … more marked than we expected

- if this points to an earlier and sharper turn in the cycle than we expected, it would suggest downside risks to our outlook

----------

NAB:

- suggests some slight downside risk to our preliminary GDP forecast (NAB currently at 0.4% q/q)

- We expect the residential construction downturn will be much deeper than the RBA's outlook

CBA:

- data doesn't augur well for Q4 GDP

- CBA look for it towards the bottom end of their previously forecast 0.25 to 0.5% range (q/q)

JP Morgan:

- were tracking 0.7% q/q on GDP … now have 0.6%

- results were on the softer side of expectations, though not as much as the headline suggests given the engineering skew, which has less translation to the flow of economic activity and payments

UBS

- cut Q4 GDP forecast to 0.3%, with further downside risk