The reflation narrative keeps the market buzzing this week

The breakout in Treasury yields towards the end of last week is holding and that is keeping with the reflation theme that is sweeping across the market in the past few weeks.

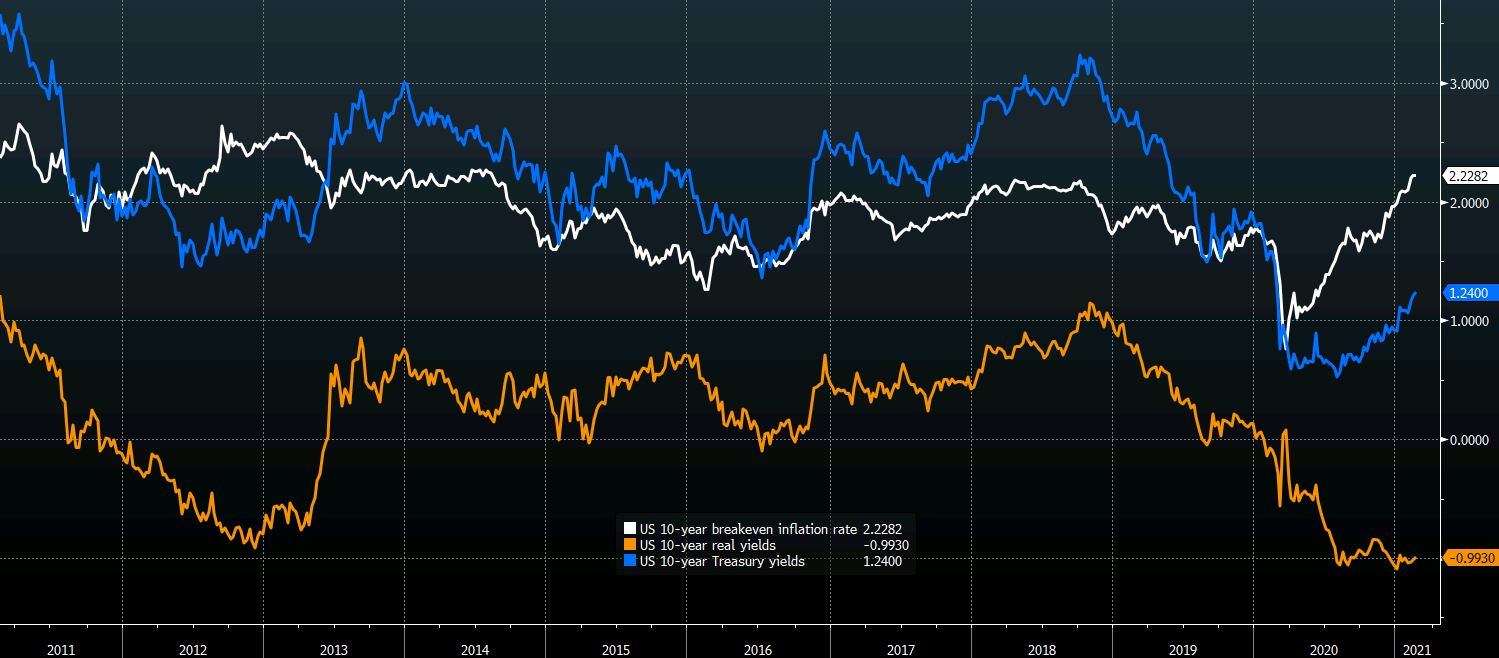

Of note, 10-year yields are holding above 1.20% and is up to 1.24% today while 30-year yields are holding above 2.00% at around 2.04% ahead of North American trading.

The push higher in yields has helped to underpin yen pairs in general but we are seeing USD/JPY pull back a little this morning as it falls to 105.20 from 105.60 earlier. This comes amid a test of its 200-day moving average as highlighted earlier.

Looking at the broader market, the rise in yields have so far done little to hurt sentiment in equities but at some point if the trend keeps up, we might get there.

For now, the reflation narrative is also keeping greed buoyed but if the bond selloff turns into a massive rout, I would expect some hints of risk aversion to kick into effect.

That said, I would imagine that might only happen if yields start to extend towards 1.50% or if we do see an intraday move that goes too far, too fast.

In any case, with real yields still largely depressed, risk trades and precious metals are likely to still shrug off any brief pullback or retracement in the big picture.

This is one chart to pay attention to as we navigate through the market this week: