Debt is no longer a four-letter word

The legacy of the coronavirus crisis may be that it kills the idea that deficits matter.

The Tea Party derailed Obama's legislative agenda, lamenting high deficits. At least 12 Senators and at least 50 members of the House were elected on Tea Party platforms. These were the most-hardcore deficit hawks in history.

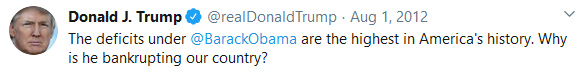

Trump vaulted himself to the White House by tapping Tea Party sentiment. Here's a sample:

For reference, the combined deficit in Obama's final four years was $2.19 trillion.

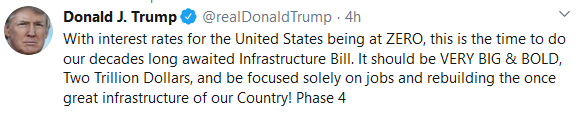

Yesterday, Trump tweeted this:

The deficit in the US this year will be at least $3 trillion and probably $4 trillion.

I'm not here to point out they hypocrisy, you can get the anywhere.

My point is that every one of those Tea Party Congressmen supported the latest stimulus bill and the huge 2017 corporate tax cut that ballooned the deficit to $1T even before this started.

It's not a US story either, deficits are exploding globally and this pandemic has destroyed any illusions of deficit discipline. When they say they can't afford $1.5 trillion in US student debt relief, it simply rings hollow.

Once you bail out someone, everyone wants a bailout.

Eventually there's a bill to pay right? Of course but the timeline might be longer than you think. Japan has been at this for 30 years. Occasionally they make a token effort at deficit reduction but they're reloading the cannon right now with more stimulus so this will hit 300% before long.

What's the future look like?

Massive deficits everywhere are here, particularly in countries that can issue their own currencies.

That's good news for risk assets and commodities but the trade is patience. Even with profligate deficit spending, it's not enough to make up for the drop in private demand.

What's clearer is that all this debt risks displacing private debt and devaluing currencies worldwide. The case for gold in the long-term has never been better.