A summary of all the worries

1) The yield curve inverting

The US 10-year note yield hit a low of 2.416% with the 3-month bill at 2.410%. We're inverted out to anything shorter than that. An inversion of the yield curve is one of the strongest signs of a recession.

The thing is, that's a big of a chicken-and-egg question. You have stocks and FX reacting to bonds but what are bonds reacting to?

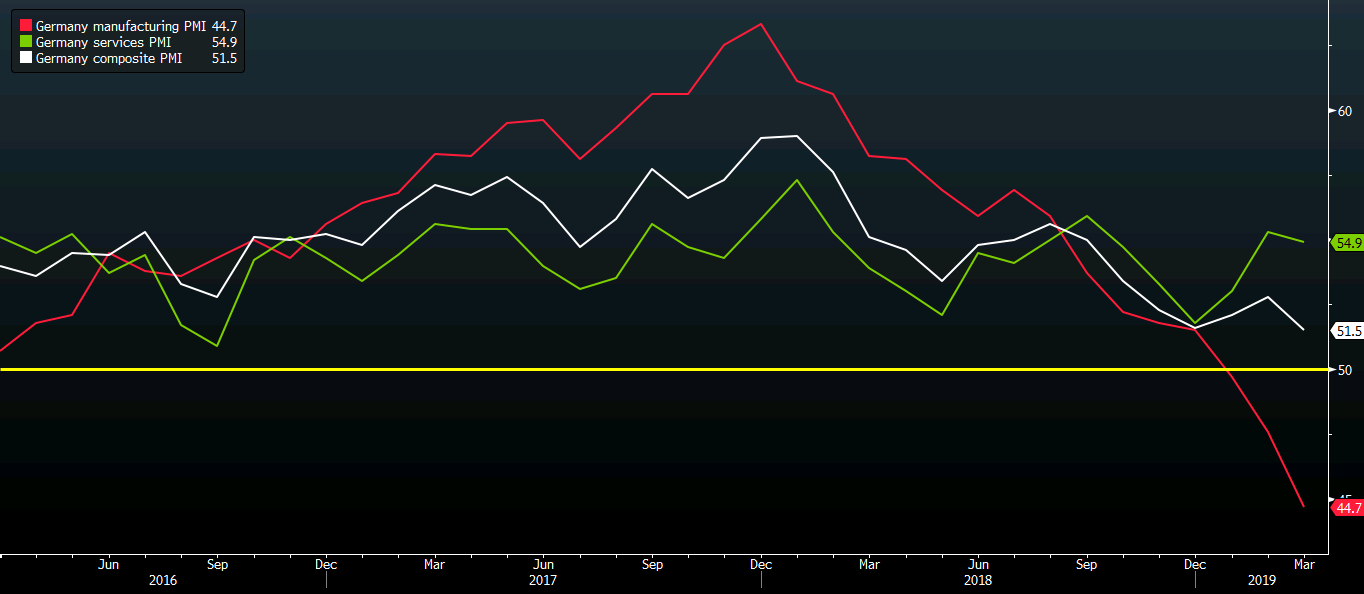

2) Europe looks bad

Today's March German flash manufacturing PMI was at 44.7 compared to 48.0 expected. It was over 60 a year ago and has been in freefall.

The last recession was led by the US but if one is coming again. It will be imported from Europe and China where growth is looking increasingly precarious.

3) Trump is politicizing the Fed

There are several reports today that Trump has offered Stephen Moore a job at the Fed. He's a political mouthpiece and harsh Powell critic. It won't end well.

4) The China trade deal is dragging on

There hasn't been any negative news and Lighthizer and Mnuchin are headed back to China for more meetings but the market had priced in a very high chance of a deal and it's not sealed yet and doesn't appear to be particularly close.

5) Brexit never ends

The pound is higher today so I'm hesitant to point to Brexit but it's a mess. There was some optimism that May could squeeze everyone at the final minute but that's fading. It's tough to see how she can survive the failure of a third meaningful vote and once she's out then UK political risks rise even higher.

6) The Fed

There are two ways too look at the Fed's surprising dovishness. One is that lower rates are good for growth. That was the message in markets yesterday. The second is that the Fed knows something we don't. History has shown repeatedly that the Fed doesn't know any more than anyone else but the market likes to flirt with the idea.