Daily thread to exchange ideas and to share your thoughts

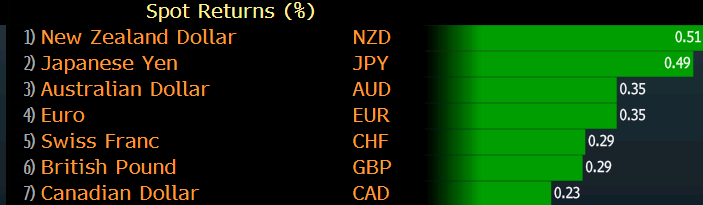

It is one-way traffic in trading to start the week with the dollar being battered across the board, while gold and silver are continuing their hot streak into the new week.

With USD/JPY breaking under 106.00 and EUR/USD threatening a further run above 1.1700, the greenback is in a really tough spot as we get things going in European trading today.

That said, given the market situation, unless we start to see a return of crisis-level fears, it is tough to imagine the dollar producing a stirring turnaround for now.

Granted the moves - especially in EUR/USD - may be a little stretched but this market loves to run with narratives for as long as it sounds good. US futures keeping a little higher after a setback on Friday isn't really helping the dollar either.

Elsewhere, gold is now trading at fresh record highs and the sky is the limit for bullion in the long-term. As for silver, another 6% jump today sees price move above $24 and that starts to bring the focus towards the August 2013 high @ $25.11 next.

Fundamentally, both still has excellent prospects as long-term investments but the fear is that the recent run may be one that is a little "too far, too fast" and may see a sharp/violent pullback down the road before investors build positions further.

What are your views on the market right now? Share your thoughts/ideas with the ForexLive community here.