UK Q2 GDP first reading now out 26 July

- 0.2% prev

- yy 1.7% as exp vs 2,0%

- index of services mm 0.2% vs 0.1% exp vs 0.2% prev

- 3mth-3mth 0.4% as exp vs 0.2% prev

- BBA mortgages 40,200 (lowest since Sept 2016) vs 40k exp vs 40280 prev

- net mortgage lending £2.42bln , highest since March 2016, vs 1.83bln prev

- net credit card lending £0.28bln vs 0.114bln prev

Bang in line with expectations albeit qq higher than previous and yy softer than previous. Higher borrowing levels remain a concern.

Services sector once again driving the data.

- UK economy has experienced a notable slowdown in H1 2017

- The growth in Quarter 2 2017 was driven by services, which grew by 0.5% compared with 0.1% growth in Quarter 1 (Jan to Mar) 2017.

- The largest contributors to growth in services were retail trade, which improved after a fall in the first quarter, and film production and distribution.

- Construction and manufacturing were the largest downward pulls on quarterly GDP growth, following 2 consecutive quarters of growth.

GBPUSD 1.3020 after a quick spike to 1.3044

EURGBP back to 0.8934 after a quick dip to 0.8913

Oh well, bring on the FOMC then for another anti climax.

Full report from ONS here

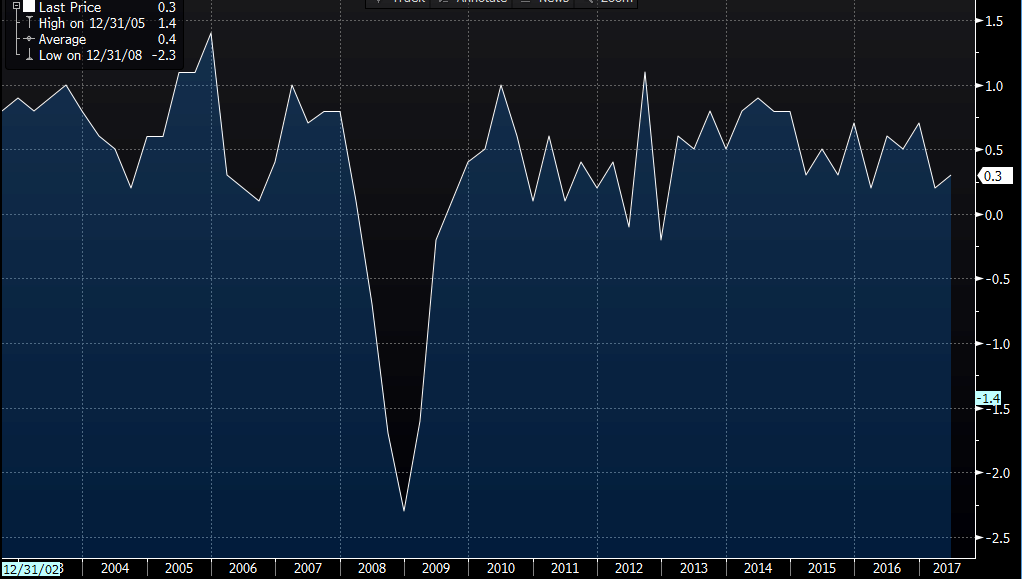

UK GDP qq