Using leverage correctly

One of the most important aspects of trading to grasp is the proper use of leverage. The use of leverage is arguably the most important aspect of risk management and proper risk management should be the top priority of all traders. Really, it should be. Managing risk is going to be the single most important factor in your success or otherwise as a forex trader and the improper use of leverage will make long term success almost impossible to achieve in the forex market. If you are struggling and losing lots of money in the FX market at the moment then trading without leverage could give you the stability you need. At the moment I am running a course in Dubai on the Palm Jumeirah and I am stressing the need for beginner traders to not use leverage in their trading to help their trading psychology.

Leverage is simply a way of trading with more money than you actually have in your account. Now using leverage can maximise gains, however it can also increase losses too. This is one of the reasons that the Financial Conduct Authority in the UK would like to reduce the amount of leverage accessible to traders. Too many people have lost their entire trading accounts by the mis-use of leverage. In June 2018 it emerged that one broker had accidentally allowed a trader to open a $5 billion dollar position. The trader, who thought he was trading a demo account, was actually placing $1 billion worth of live orders for US and European equity futures. The trader ended up with a profit of $10 million dollars, but his initial deposit with the broker had only been $20K. He was using leverage over 200 thousand times above his initial deposit. When you consider that the broker in question only made a profit of $9.6 million last year you can see the enormous risk that leverage can pose. So, the first step in using leverage is to understand exactly what it is.

What is leverage?

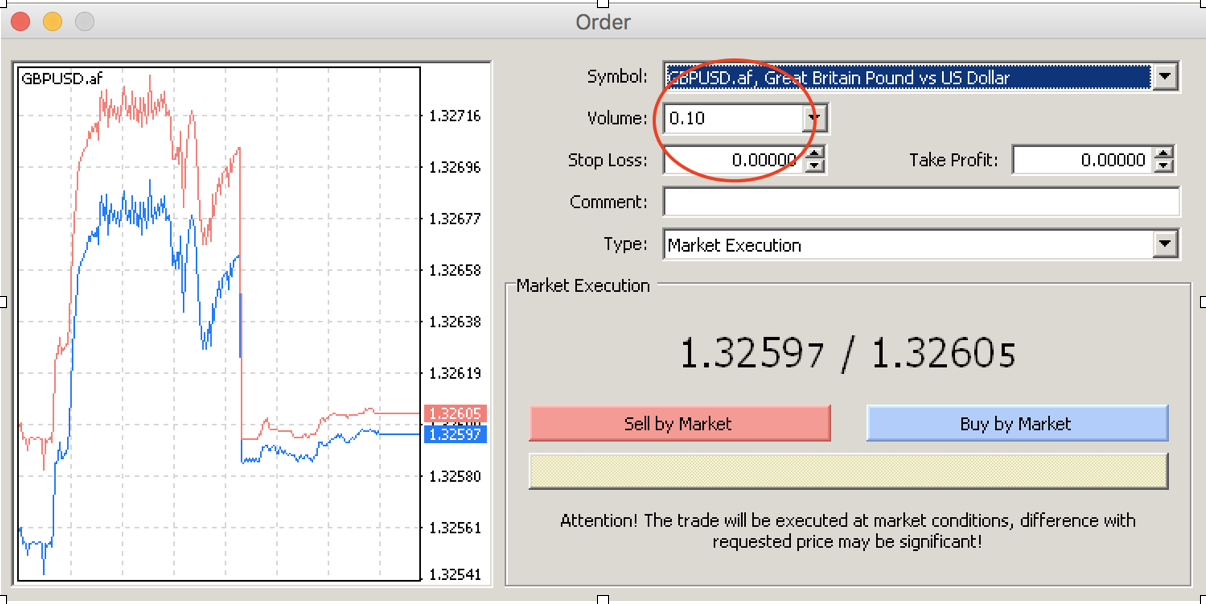

The best way to understand leverage is to think of your trade size (how much you are trading with) vs your account size (how much you have in your account). So, for example, lets say that you have 10000 USD in your account. if you buy 1 standard mini lot (0.10) - you are now considered to be trading unleveraged. This is because your trade size is equivalent to the amount of money in your account. Your position size is one mini lot, 10000USD, and your account size is 10000USD. They are the same. In the pictures below you will see an order opened on an MT4 account . The trade size is 1 mini lot or 0.10. A position opened in this scenario would be for a trader not using any leverage with a 10000USD acccount.

If that trader, with the same account size of 10000 USD, then went on to open a second mini lot position of 0.10, then that trader would be using leverage of 2:1 This means that they are trading with double the trade size in relation to their account. Their trade size would be 20000 USD , yet their account size is 10000USD. For each subsequent 0.1 trade position the trader opens, the higher amount of leverage they will be using in their account: 3:1, 4:1, 5:1 and so on.

How to use leverage professionally

Now just because you can use leverage it does not mean that you should. Professional traders, working for large institutional banks, brokers and funds use very low levels of leverage. In fact, as a general rule, for working out their trade size they will use unleveraged positions. As explained above that will mean that their trade size matches their account size. So, a trader, operating a $1 million USD account would only use 10 standard lots as their normal, unleveraged position. At first, it may seem strange that a professional trader would not utilise these high levels of leverage. So, tomorrow and Friday we will look at the benefits of trading without leverage.